Clear Form

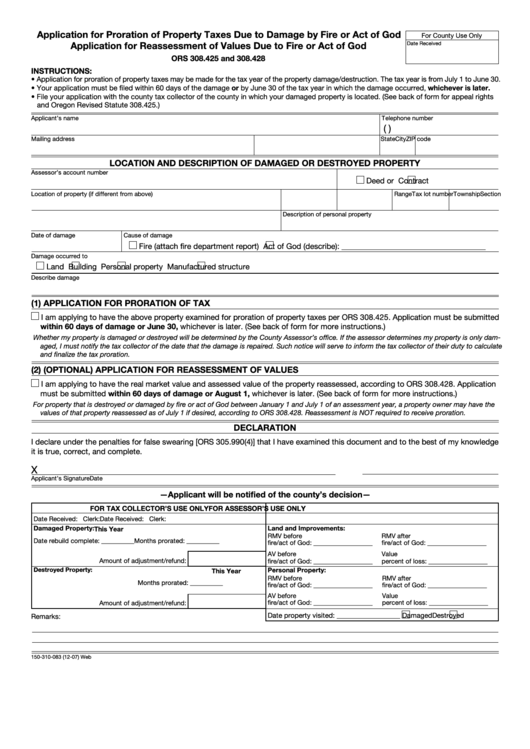

Application for Proration of Property Taxes Due to Damage by Fire or Act of God

For County Use Only

Application for Reassessment of Values Due to Fire or Act of God

Date Received

ORS 308.425 and 308.428

INSTRUCTIONS:

• Application for proration of property taxes may be made for the tax year of the property damage/destruction. The tax year is from July 1 to June 30.

• Your application must be filed within 60 days of the damage or by June 30 of the tax year in which the damage occurred, whichever is later.

• File your application with the county tax collector of the county in which your damaged property is located. (See back of form for appeal rights

and Oregon Revised Statute 308.425.)

Applicant’s name

Telephone number

(

)

Mailing address

City

State

ZIP code

LOCATION AND DESCRIPTION OF DAMAGED OR DESTROYED PROPERTY

Assessor’s account number

Deed or

Contract

Location of property (if different from above)

Section

Township

Range

Tax lot number

Description of personal property

Date of damage

Cause of damage

Fire (attach fire department report)

Act of God (describe): _____________________________________

Damage occurred to

Land

Building

Personal property

Manufactured structure

Describe damage

(1)

APPLICATION FOR PRORATION OF TAX

I am applying to have the above property examined for proration of property taxes per ORS 308.425. Application must be submitted

within 60 days of damage or June 30, whichever is later. (See back of form for more instructions.)

Whether my property is damaged or destroyed will be determined by the County Assessor’s office. If the assessor determines my property is only dam-

aged, I must notify the tax collector of the date that the damage is repaired. Such notice will serve to inform the tax collector of their duty to calculate

and finalize the tax proration.

(2) (OPTIONAL)

APPLICATION FOR REASSESSMENT OF VALUES

I am applying to have the real market value and assessed value of the property reassessed, according to ORS 308.428. Application

must be submitted within 60 days of damage or August 1, whichever is later. (See back of form for more instructions.)

For property that is destroyed or damaged by fire or act of God between January 1 and July 1 of an assessment year, a property owner may have the

values of that property reassessed as of July 1 if desired, according to ORS 308.428. Reassessment is NOT required to receive proration.

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best of my knowledge

it is true, correct, and complete.

X

Applicant’s Signature

Date

—Applicant will be notified of the county’s decision—

FOR TAX COLLECTOR’S USE ONLY

FOR ASSESSOR’S USE ONLY

Date Received:

Clerk:

Date Received:

Clerk:

Damaged Property:

Land and Improvements:

This Year

RMV before

RMV after

Date rebuild complete: __________ Months prorated: __________

fire/act of God: __________________

fire/act of God: __________________

AV before

Value

Amount of adjustment/refund:

fire/act of God: __________________

percent of loss: __________________

Destroyed Property:

Personal Property:

This Year

RMV before

RMV after

Months prorated: __________

fire/act of God: __________________

fire/act of God: __________________

AV before

Value

Amount of adjustment/refund:

fire/act of God: __________________

percent of loss: __________________

Date property visited: __________________

Damaged

Destroyed

Remarks:

150-310-083 (12-07) Web

1

1 2

2