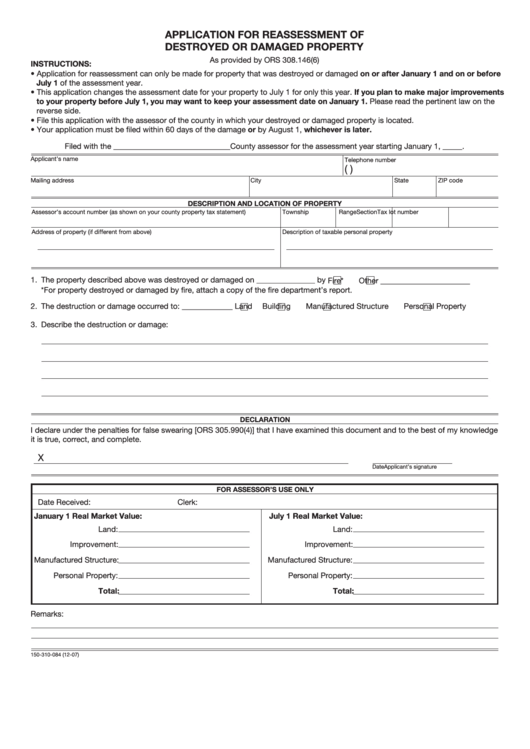

Clear Form

APPLICATION FOR REASSESSMENT OF

DESTROYED OR DAMAGED PROPERTY

As provided by ORS 308.146(6)

INSTRUCTIONS:

• Application for reassessment can only be made for property that was destroyed or damaged on or after January 1 and on or before

July 1 of the assessment year.

• This application changes the assessment date for your property to July 1 for only this year. If you plan to make major improvements

to your property before July 1, you may want to keep your assessment date on January 1. Please read the pertinent law on the

reverse side.

• File this application with the assessor of the county in which your destroyed or damaged property is located.

• Your application must be filed within 60 days of the damage or by August 1, whichever is later.

Filed with the ______________________________County assessor for the assessment year starting January 1, _____.

Applicant’s name

Telephone number

(

)

Mailing address

City

State

ZIP code

DESCRIPTION AND LOCATION OF PROPERTY

Assessor’s account number (as shown on your county property tax statement)

Township

Range

Section

Tax lot number

Address of property (if different from above)

Description of taxable personal property

1. The property described above was destroyed or damaged on _______________ by

Fire*

Other _______________________

*For property destroyed or damaged by fire, attach a copy of the fire department’s report.

2. The destruction or damage occurred to: _____________

Land

Building

Manufactured Structure

Personal Property

3. Describe the destruction or damage:

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best of my knowledge

it is true, correct, and complete.

X

Applicant’s signature

Date

FOR ASSESSOR’S USE ONLY

Date Received:

Clerk:

January 1 Real Market Value:

July 1 Real Market Value:

Land:

Land:

Improvement:

Improvement:

Manufactured Structure:

Manufactured Structure:

Personal Property:

Personal Property:

Total:

Total:

Remarks:

150-310-084 (12-07)

1

1 2

2