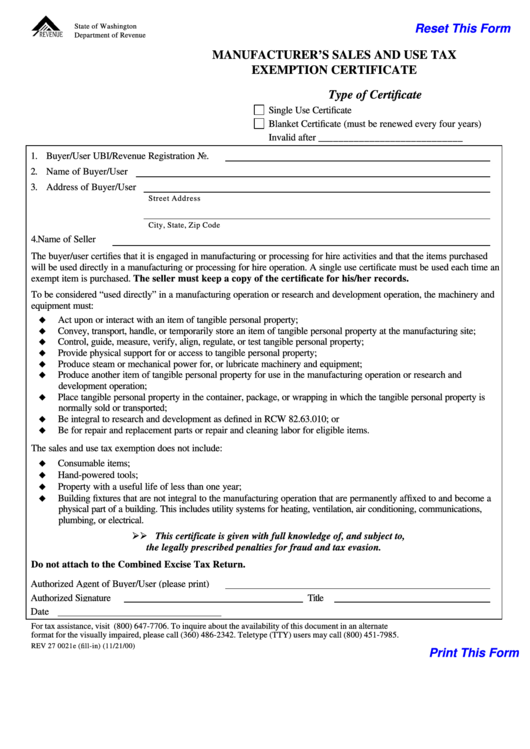

State of Washington

Reset This Form

Department of Revenue

MANUFACTURER’S SALES AND USE TAX

EXEMPTION CERTIFICATE

Type of Certificate

Single Use Certificate

Blanket Certificate (must be renewed every four years)

Invalid after ____________________________

1. Buyer/User UBI/Revenue Registration No.

2. Name of Buyer/User

3. Address of Buyer/User

Street Address

City, State, Zip Code

4. Name of Seller

The buyer/user certifies that it is engaged in manufacturing or processing for hire activities and that the items purchased

will be used directly in a manufacturing or processing for hire operation. A single use certificate must be used each time an

exempt item is purchased. The seller must keep a copy of the certificate for his/her records.

To be considered “used directly” in a manufacturing operation or research and development operation, the machinery and

equipment must:

u

Act upon or interact with an item of tangible personal property;

u

Convey, transport, handle, or temporarily store an item of tangible personal property at the manufacturing site;

u

Control, guide, measure, verify, align, regulate, or test tangible personal property;

u

Provide physical support for or access to tangible personal property;

u

Produce steam or mechanical power for, or lubricate machinery and equipment;

u

Produce another item of tangible personal property for use in the manufacturing operation or research and

development operation;

u

Place tangible personal property in the container, package, or wrapping in which the tangible personal property is

normally sold or transported;

u

Be integral to research and development as defined in RCW 82.63.010; or

u

Be for repair and replacement parts or repair and cleaning labor for eligible items.

The sales and use tax exemption does not include:

u

Consumable items;

u

Hand-powered tools;

u

Property with a useful life of less than one year;

u

Building fixtures that are not integral to the manufacturing operation that are permanently affixed to and become a

physical part of a building. This includes utility systems for heating, ventilation, air conditioning, communications,

plumbing, or electrical.

Ø Ø This certificate is given with full knowledge of, and subject to,

the legally prescribed penalties for fraud and tax evasion.

Do not attach to the Combined Excise Tax Return.

Authorized Agent of Buyer/User (please print)

Authorized Signature

Title

Date

For tax assistance, visit or call (800) 647-7706. To inquire about the availability of this document in an alternate

format for the visually impaired, please call (360) 486-2342. Teletype (TTY) users may call (800) 451-7985.

REV 27 0021e (fill-in) (11/21/00)

Print This Form

1

1