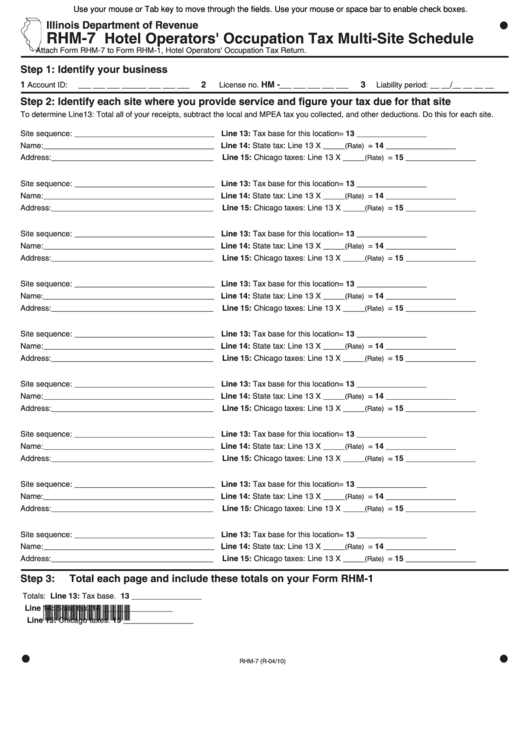

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RHM-7

Hotel Operators' Occupation Tax Multi-Site Schedule

Attach Form RHM-7 to Form RHM-1, Hotel Operators' Occupation Tax Return.

Step 1:

Identify your business

1

2

HM -

3

Account ID: ___ ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ ___

L icense no.

Liability period: __ __/__ __ __ __

Step 2:

Identify each site where you provide service and figure your tax due for that site

To determine Line13: Total all of your receipts, subtract the local and MPEA tax you collected, and other deductions. Do this for each site.

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Name:_______________________________________

Line 14: State tax: Line 13 X _____

=

14 ________________

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Name:_______________________________________

Line 14: State tax: Line 13 X _____

=

14 ________________

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Name:_______________________________________

Line 14: State tax: Line 13 X _____

=

14 ________________

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Name:_______________________________________

Line 14: State tax: Line 13 X _____

=

14 ________________

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Line 14: State tax: Line 13 X _____

14 ________________

Name:_______________________________________

=

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Line 14: State tax: Line 13 X _____

14 ________________

Name:_______________________________________

=

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Line 14: State tax: Line 13 X _____

14 ________________

Name:_______________________________________

=

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Line 14: State tax: Line 13 X _____

14 ________________

Name:_______________________________________

=

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Line 13: Tax base for this location

13 ________________

Site sequence: ________________________________

=

Line 14: State tax: Line 13 X _____

14 ________________

Name:_______________________________________

=

(Rate)

Address:_____________________________________

Line 15: Chicago taxes: Line 13 X _____

=

15 ________________

(Rate)

Step 3: Total each page and include these totals on your Form RHM-1

Totals:

Line 13: Tax base.

13 ________________

Line 14: State tax.

14 ________________

*047621110*

Line 15: Chicago taxes. 15 ________________

RHM-7 (R-04/10)

1

1 2

2