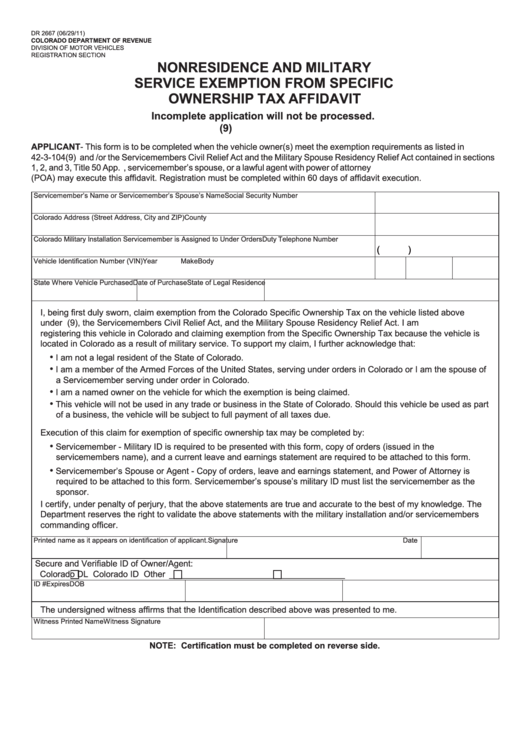

DR 2667 (06/29/11)

COLORADO DEPARTMENT OF REVENUE

DIVISION OF MOTOR VEHICLES

REGISTRATION SECTION

NONRESIDENCE AND MILITARY

SERVICE EXEMPTION FROM SPECIFIC

OWNERSHIP TAX AFFIDAVIT

Incomplete application will not be processed.

C.R.S. 42-3-104(9)

APPLICANT - This form is to be completed when the vehicle owner(s) meet the exemption requirements as listed in C.R.S.

42-3-104(9) and /or the Servicemembers Civil Relief Act and the Military Spouse Residency Relief Act contained in sections

1, 2, and 3, Title 50 App. U.S.C. Only the military individual, servicemember’s spouse, or a lawful agent with power of attorney

(POA) may execute this affidavit. Registration must be completed within 60 days of affidavit execution.

Servicemember’s Name or Servicemember’s Spouse’s Name

Social Security Number

Colorado Address (Street Address, City and ZIP)

County

Colorado Military Installation Servicemember is Assigned to Under Orders

Duty Telephone Number

(

)

Vehicle Identification Number (VIN)

Year

Make

Body

State Where Vehicle Purchased

Date of Purchase

State of Legal Residence

I, being first duly sworn, claim exemption from the Colorado Specific Ownership Tax on the vehicle listed above

under C.R.S. 42-3-104(9), the Servicemembers Civil Relief Act, and the Military Spouse Residency Relief Act. I am

registering this vehicle in Colorado and claiming exemption from the Specific Ownership Tax because the vehicle is

located in Colorado as a result of military service. To support my claim, I further acknowledge that:

•

I am not a legal resident of the State of Colorado.

•

I am a member of the Armed Forces of the United States, serving under orders in Colorado or I am the spouse of

a Servicemember serving under order in Colorado.

•

I am a named owner on the vehicle for which the exemption is being claimed.

•

This vehicle will not be used in any trade or business in the State of Colorado. Should this vehicle be used as part

of a business, the vehicle will be subject to full payment of all taxes due.

Execution of this claim for exemption of specific ownership tax may be completed by:

•

Servicemember - Military ID is required to be presented with this form, copy of orders (issued in the

servicemembers name), and a current leave and earnings statement are required to be attached to this form.

•

Servicemember’s Spouse or Agent - Copy of orders, leave and earnings statement, and Power of Attorney is

required to be attached to this form. Servicemember’s spouse’s military ID must list the servicemember as the

sponsor.

I certify, under penalty of perjury, that the above statements are true and accurate to the best of my knowledge. The

Department reserves the right to validate the above statements with the military installation and/or servicemembers

commanding officer.

Printed name as it appears on identification of applicant.

Signature

Date

Secure and Verifiable ID of Owner/Agent:

Colorado DL

Colorado ID

Other _____________________________________

ID #

Expires

DOB

The undersigned witness affirms that the Identification described above was presented to me.

Witness Printed Name

Witness Signature

NOTE: Certification must be completed on reverse side.

1

1 2

2