Form-W1 - Statement Of Employer'S Tax Withheld 2015

ADVERTISEMENT

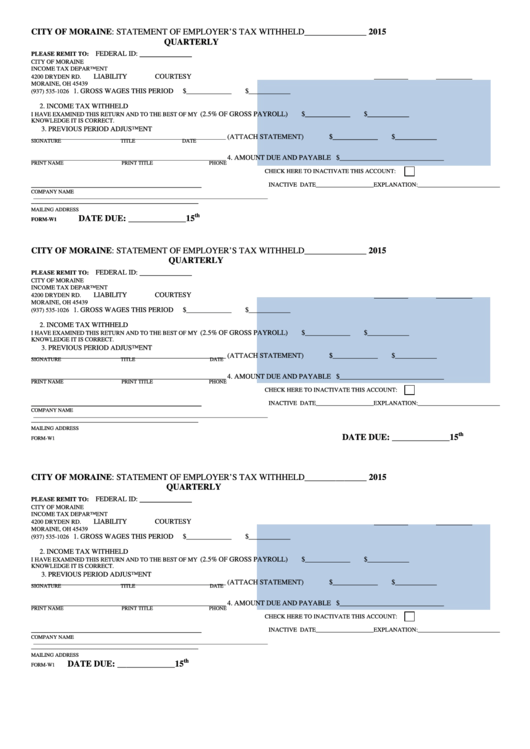

CITY OF MORAINE: STATEMENT OF EMPLOYER’S TAX WITHHELD

______________ 2015

QUARTERLY

__________

FEDERAL ID:

PLEASE REMIT TO:

CITY OF MORAINE

INCOME TAX DEPARTMENT

LIABILITY

COURTESY

4200 DRYDEN RD.

MORAINE, OH 45439

1. GROSS WAGES THIS PERIOD

$_____________

$____________

(937) 535-1026

2. INCOME TAX WITHHELD

(2.5% OF GROSS PAYROLL)

$_____________

$____________

I HAVE EXAMINED THIS RETURN AND TO THE BEST OF MY

KNOWLEDGE IT IS CORRECT.

3. PREVIOUS PERIOD ADJUSTMENT

(ATTACH STATEMENT)

$_____________

$____________

________________________________________________________________

SIGNATURE

TITLE

DATE

4. AMOUNT DUE AND PAYABLE $______________________________

________________________________________________________________

PRINT NAME

PRINT TITLE

PHONE

CHECK HERE TO INACTIVATE THIS ACCOUNT:

___________________________________

INACTIVE DATE___________________EXPLANATION:___________________________

COMPANY NAME

___________________________________________________________________________________________________________

________________________________________________

MAILING ADDRESS

th

DATE DUE: _____________15

FORM-W1

CITY OF MORAINE: STATEMENT OF EMPLOYER’S TAX WITHHELD

______________ 2015

QUARTERLY

__________

FEDERAL ID:

PLEASE REMIT TO:

CITY OF MORAINE

INCOME TAX DEPARTMENT

LIABILITY

COURTESY

4200 DRYDEN RD.

MORAINE, OH 45439

1. GROSS WAGES THIS PERIOD

$_____________

$____________

(937) 535-1026

2. INCOME TAX WITHHELD

(2.5% OF GROSS PAYROLL)

$_____________

$____________

I HAVE EXAMINED THIS RETURN AND TO THE BEST OF MY

KNOWLEDGE IT IS CORRECT.

3. PREVIOUS PERIOD ADJUSTMENT

(ATTACH STATEMENT)

$_____________

$____________

________________________________________________________________

SIGNATURE

TITLE

DATE

4. AMOUNT DUE AND PAYABLE $______________________________

________________________________________________________________

PRINT NAME

PRINT TITLE

PHONE

CHECK HERE TO INACTIVATE THIS ACCOUNT:

___________________________________

INACTIVE DATE___________________EXPLANATION:___________________________

COMPANY NAME

___________________________________________________________________________________________________________

________________________________________________

MAILING ADDRESS

th

DATE DUE: _____________15

FORM-W1

CITY OF MORAINE: STATEMENT OF EMPLOYER’S TAX WITHHELD

______________ 2015

QUARTERLY

__________

FEDERAL ID:

PLEASE REMIT TO:

CITY OF MORAINE

INCOME TAX DEPARTMENT

LIABILITY

COURTESY

4200 DRYDEN RD.

MORAINE, OH 45439

1. GROSS WAGES THIS PERIOD

$_____________

$____________

(937) 535-1026

2. INCOME TAX WITHHELD

(2.5% OF GROSS PAYROLL)

$_____________

$____________

I HAVE EXAMINED THIS RETURN AND TO THE BEST OF MY

KNOWLEDGE IT IS CORRECT.

3. PREVIOUS PERIOD ADJUSTMENT

(ATTACH STATEMENT)

$_____________

$____________

________________________________________________________________

SIGNATURE

TITLE

DATE

4. AMOUNT DUE AND PAYABLE $______________________________

________________________________________________________________

PRINT NAME

PRINT TITLE

PHONE

CHECK HERE TO INACTIVATE THIS ACCOUNT:

___________________________________

INACTIVE DATE___________________EXPLANATION:___________________________

COMPANY NAME

___________________________________________________________________________________________________________

________________________________________________

MAILING ADDRESS

th

DATE DUE: _____________15

FORM-W1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1