Out Of Town Business License Application Form - City Of Glenwood Springs

ADVERTISEMENT

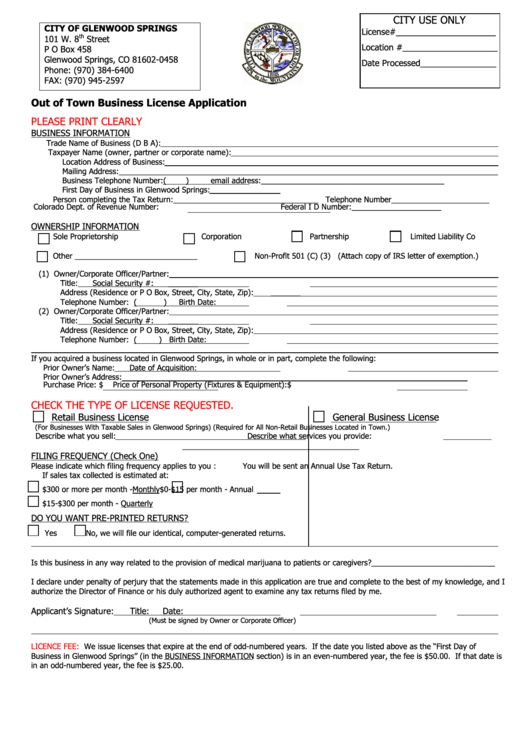

CITY USE ONLY

CITY OF GLENWOOD SPRINGS

License#_____________________

th

101 W. 8

Street

Location #____________________

P O Box 458

Glenwood Springs, CO 81602-0458

Date Processed________________

Phone: (970) 384-6400

FAX: (970) 945-2597

Out of Town Business License Application

PLEASE PRINT CLEARLY

BUSINESS INFORMATION

Trade Name of Business (D B A):

Taxpayer Name (owner, partner or corporate name):

Location Address of Business:

Mailing Address:_________________________________________________________________________________________

Business Telephone Number:(

)

email address:___________________________________________

First Day of Business in Glenwood Springs:

Person completing the Tax Return:__________________________________ Telephone Number_______________________

Colorado Dept. of Revenue Number:

Federal I D Number:_____________________

OWNERSHIP INFORMATION

Sole Proprietorship

Corporation

Partnership

Limited Liability Co

Other

Non-Profit 501 (C) (3) (Attach copy of IRS letter of exemption.)

____________________________

(1) Owner/Corporate Officer/Partner:

Title:

Social Security #:

_______

Address (Residence or P O Box, Street, City, State, Zip):

_______

Telephone Number:

(

)

Birth Date:

(2) Owner/Corporate Officer/Partner:

Title:

Social Security #:

_______

Address (Residence or P O Box, Street, City, State, Zip):

Telephone Number:

(

)

Birth Date:

If you acquired a business located in Glenwood Springs, in whole or in part, complete the following:

Prior Owner’s Name:

Date of Acquisition:

Prior Owner’s Address:

Purchase Price: $

Price of Personal Property (Fixtures & Equipment):$

CHECK THE TYPE OF LICENSE REQUESTED.

Retail Business License

General Business License

(For Businesses With Taxable Sales in Glenwood Springs)

(Required for All Non-Retail Businesses Located in Town.)

Describe what you sell:

Describe what services you provide:

________________________________________

FILING FREQUENCY (Check One)

Please indicate which filing frequency applies to you :

You will be sent an Annual Use Tax Return.

If sales tax collected is estimated at:

$300 or more per month -Monthly

$0-$15 per month - Annual

$15-$300 per month - Quarterly

DO YOU WANT PRE-PRINTED RETURNS?

Yes

No, we will file our identical, computer-generated returns.

Is this business in any way related to the provision of medical marijuana to patients or caregivers?_____________________________

I declare under penalty of perjury that the statements made in this application are true and complete to the best of my knowledge, and I

authorize the Director of Finance or his duly authorized agent to examine any tax returns filed by me.

Applicant’s Signature:

Title:

Date:

(Must be signed by Owner or Corporate Officer)

LICENCE FEE:

We issue licenses that expire at the end of odd-numbered years. If the date you listed above as the “First Day of

Business in Glenwood Springs” (in the BUSINESS INFORMATION section) is in an even-numbered year, the fee is $50.00. If that date is

in an odd-numbered year, the fee is $25.00.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1