RESET FORM

PRINT FORM

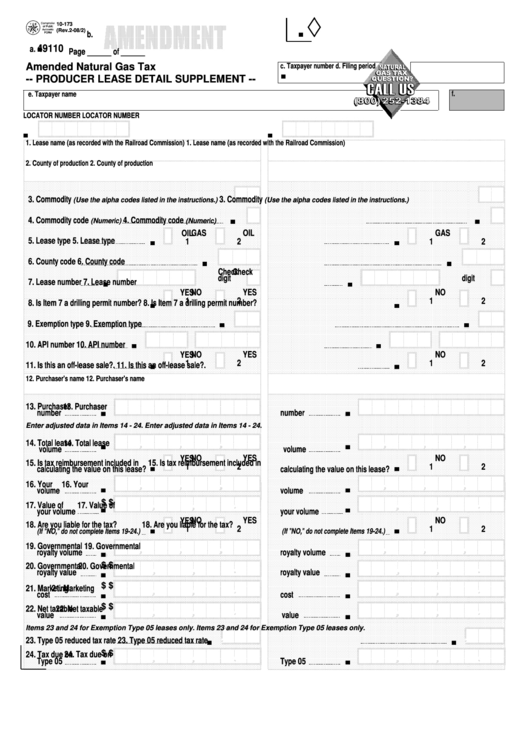

10-173

(Rev.2-08/2)

b.

49110

a.

Page ______ of ______

Amended Natural Gas Tax

c. Taxpayer number

d. Filing period

-- PRODUCER LEASE DETAIL SUPPLEMENT --

f.

e. Taxpayer name

LOCATOR NUMBER

LOCATOR NUMBER

1. Lease name (as recorded with the Railroad Commission)

1. Lease name (as recorded with the Railroad Commission)

2. County of production

2. County of production

3. Commodity

3. Commodity

(Use the alpha codes listed in the instructions.)

(Use the alpha codes listed in the instructions.)

4. Commodity code

4. Commodity code

(Numeric)

(Numeric)

OIL

GAS

OIL

GAS

5. Lease type

5. Lease type

1

2

1

2

6. County code

6. County code

Check

Check

digit

digit

7. Lease number

7. Lease number

YES

NO

YES

NO

1

2

1

2

8. Is Item 7 a drilling permit number?

8. Is Item 7 a drilling permit number?

9. Exemption type

9. Exemption type

10. API number

10. API number

YES

NO

YES

NO

1

2

1

2

11. Is this an off-lease sale?.

11. Is this an off-lease sale?.

12. Purchaser's name

12. Purchaser's name

13. Purchaser

13. Purchaser

number

number

Enter adjusted data in Items 14 - 24.

Enter adjusted data in Items 14 - 24.

14. Total lease

14. Total lease

volume

volume

YES

NO

YES

NO

15. Is tax reimbursement included in

15. Is tax reimbursement included in

1

2

1

2

calculating the value on this lease?

calculating the value on this lease?

16. Your

16. Your

volume

volume

$

$

17. Value of

17. Value of

your volume

your volume

YES

NO

YES

NO

18. Are you liable for the tax?

18. Are you liable for the tax?

1

2

1

2

(If "NO," do not complete Items 19-24.)

(If "NO," do not complete Items 19-24.)

19. Governmental

19. Governmental

royalty volume

royalty volume

$

$

20. Governmental

20. Governmental

royalty value

royalty value

$

$

21. Marketing

21. Marketing

cost

cost

$

$

22. Net taxable

22. Net taxable

value

value

Items 23 and 24 for Exemption Type 05 leases only.

Items 23 and 24 for Exemption Type 05 leases only.

23. Type 05 reduced tax rate

23. Type 05 reduced tax rate

$

$

24. Tax due on

24. Tax due on

Type 05

Type 05

1

1 2

2