Form Dr-18 - Application For Amusement Machine Certificate

ADVERTISEMENT

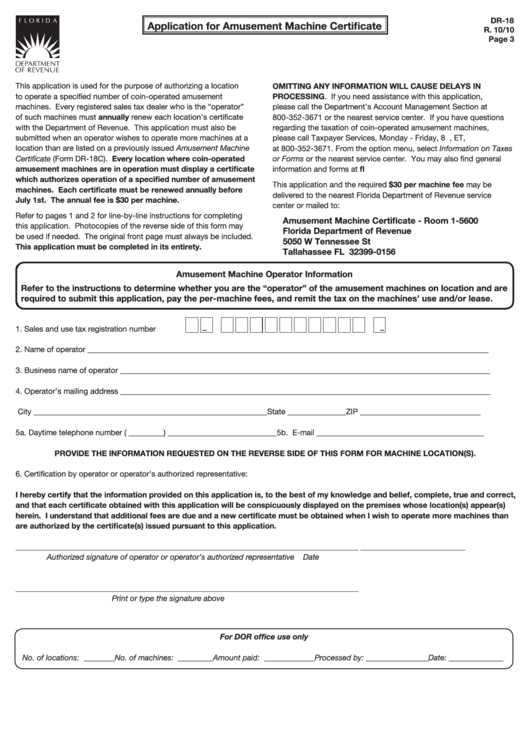

DR-18

Application for Amusement Machine Certificate

R. 10/10

Page 3

This application is used for the purpose of authorizing a location

OMITTING ANY INFORMATION WILL CAUSE DELAYS IN

to operate a specified number of coin-operated amusement

PROCESSING. If you need assistance with this application,

machines. Every registered sales tax dealer who is the “operator”

please call the Department’s Account Management Section at

of such machines must annually renew each location’s certificate

800-352-3671 or the nearest service center. If you have questions

with the Department of Revenue. This application must also be

regarding the taxation of coin-operated amusement machines,

submitted when an operator wishes to operate more machines at a

please call Taxpayer Services, Monday - Friday, 8 a.m. to 7 p.m., ET,

location than are listed on a previously issued Amusement Machine

at 800-352-3671. From the option menu, select Information on Taxes

Certificate (Form DR-18C). Every location where coin-operated

or Forms or the nearest service center. You may also find general

amusement machines are in operation must display a certificate

information and forms at

which authorizes operation of a specified number of amusement

This application and the required $30 per machine fee may be

machines. Each certificate must be renewed annually before

delivered to the nearest Florida Department of Revenue service

July 1st. The annual fee is $30 per machine.

center or mailed to:

Refer to pages 1 and 2 for line-by-line instructions for completing

Amusement Machine Certificate - Room 1-5600

this application. Photocopies of the reverse side of this form may

Florida Department of Revenue

be used if needed. The original front page must always be included.

5050 W Tennessee St

This application must be completed in its entirety.

Tallahassee FL 32399-0156

Amusement Machine Operator Information

Refer to the instructions to determine whether you are the “operator” of the amusement machines on location and are

required to submit this application, pay the per-machine fees, and remit the tax on the machines’ use and/or lease.

1.

Sales and use tax registration number

–

–

2.

Name of operator _______________________________________________________________________________________________________

3.

Business name of operator _______________________________________________________________________________________________

4.

Operator’s mailing address _______________________________________________________________________________________________

City ____________________________________________________________ State _______________ ZIP _______________________________

5a.

Daytime telephone number

( _________ ) ____________________________5b. E-mail ___________________________________________

PROVIDE THE INFORMATION REQUESTED ON THE REVERSE SIDE OF THIS FORM FOR MACHINE LOCATION(S).

6.

Certification by operator or operator’s authorized representative:

I hereby certify that the information provided on this application is, to the best of my knowledge and belief, complete, true and correct,

and that each certificate obtained with this application will be conspicuously displayed on the premises whose location(s) appear(s)

herein. I understand that additional fees are due and a new certificate must be obtained when I wish to operate more machines than

are authorized by the certificate(s) issued pursuant to this application.

________________________________________________________________________________________

___________________________

Authorized signature of operator or operator’s authorized representative

Date

________________________________________________________________________________________

Print or type the signature above

For DOR office use only

No. of locations: ________No. of machines: _________ Amount paid: _____________ Processed by: ________________ Date: ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2