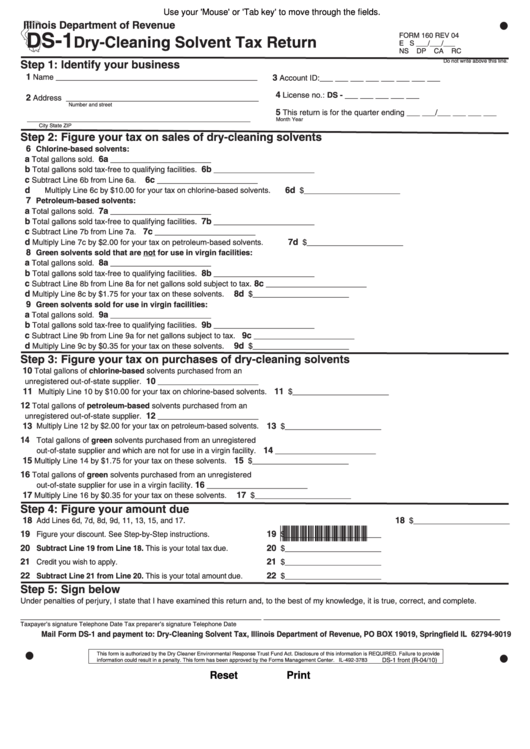

Use your 'Mouse' or 'Tab key' to move through the fields.

Illinois Department of Revenue

DS-1

FORM 160

REV 04

Dry-Cleaning Solvent Tax Return

E S

___/___/___

NS DP CA RC

Step 1: Identify your business

Do not write above this line.

1

3

Name ______________________________________________

Account ID:___ ___ ___ ___ ___ ___ ___ ___

4

License no.: DS - ___ ___ ___ ___ ___

2

Address ____________________________________________

Number and street

5

This return is for the quarter ending ___ ___/___ ___ ___ ___

___________________________________________________

Month

Year

City

State

ZIP

Step 2: Figure your tax on sales of dry-cleaning solvents

6

Chlorine-based solvents:

a

6a

Total gallons sold.

_______________________

b

6b

Total gallons sold tax-free to qualifying facilities.

_______________________

c

6c

Subtract Line 6b from Line 6a.

_______________________

d

6d

Multiply Line 6c by $10.00 for your tax on chlorine-based solvents.

$______________________

7

Petroleum-based solvents:

a

7a

Total gallons sold.

_______________________

b

7b

Total gallons sold tax-free to qualifying facilities.

_______________________

c

7c

Subtract Line 7b from Line 7a.

_______________________

d

7d

Multiply Line 7c by $2.00 for your tax on petroleum-based solvents.

$______________________

8

Green solvents sold that are not for use in virgin facilities:

a

8a

Total gallons sold.

_______________________

b

8b

Total gallons sold tax-free to qualifying facilities.

_______________________

c

8c

Subtract Line 8b from Line 8a for net gallons sold subject to tax.

_______________________

d

8d

Multiply Line 8c by $1.75 for your tax on these solvents.

$______________________

9

Green solvents sold for use in virgin facilities:

a

9a

Total gallons sold.

_______________________

b

9b

Total gallons sold tax-free to qualifying facilities.

_______________________

c

9c

Subtract Line 9b from Line 9a for net gallons subject to tax.

_______________________

d

9d

Multiply Line 9c by $0.35 for your tax on these solvents.

$______________________

Step 3: Figure your tax on purchases of dry-cleaning solvents

1 0

Total gallons of chlorine-based solvents purchased from an

10

unregistered out-of-state supplier.

_______________________

1 1

11

Multiply Line 10 by $10.00 for your tax on chlorine-based solvents.

$______________________

12

Total gallons of petroleum-based solvents purchased from an

12

unregistered out-of-state supplier.

_______________________

1 3

13

Multiply Line 12 by $2.00 for your tax on petroleum-based solvents.

$______________________

14

Total gallons of green solvents purchased from an unregistered

14

out-of-state supplier and which are not for use in a virgin facility.

_______________________

1 5

15

Multiply Line 14 by $1.75 for your tax on these solvents.

$______________________

16

Total gallons of green solvents purchased from an unregistered

16

out-of-state supplier for use in a virgin facility.

_______________________

1 7

17

Multiply Line 16 by $0.35 for your tax on these solvents.

$______________________

Step 4: Figure your amount due

1 8

18

Add Lines 6d, 7d, 8d, 9d, 11, 13, 15, and 17.

$______________________

*016021110*

19

19

Figure your discount. See Step-by-Step instructions.

$______________________

20

20

Subtract Line 19 from Line 18. This is your total tax due.

$______________________

21

21

Credit you wish to apply.

$______________________

22

22

Subtract Line 21 from Line 20. This is your total amount due.

$______________________

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

______________________________________________________

Taxpayer’s signature

Telephone

Date

Tax preparer’s signature

Telephone

Date

Mail Form DS-1 and payment to: Dry-Cleaning Solvent Tax, Illinois Department of Revenue, PO BOX 19019, Springfield IL 62794-9019

This form is authorized by the Dry Cleaner Environmental Response Trust Fund Act. Disclosure of this information is REQUIRED. Failure to provide

DS-1 front (R-04/10)

information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-3783

Reset

Print

1

1