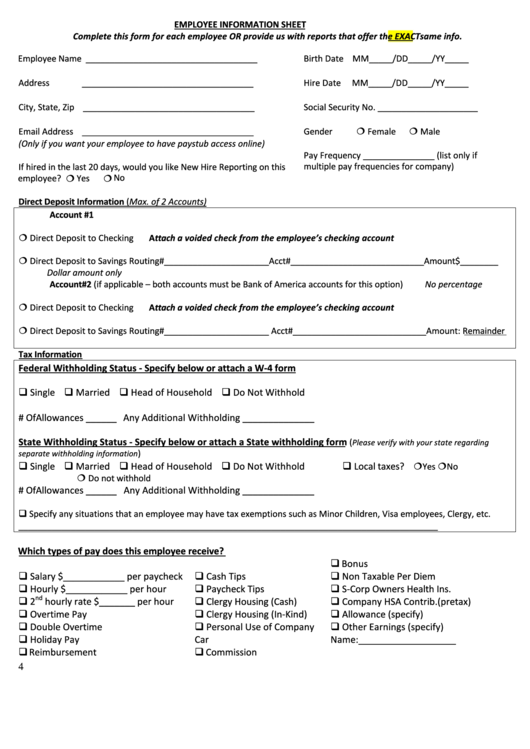

EMPLOYEE INFORMATION SHEET

Complete this form for each employee OR provide us with reports that offer the EXACT same info.

Employee Name ____________________________________

Birth Date MM_____/DD_____/YY_____

Address

____________________________________

Hire Date

MM_____/DD_____/YY_____

City, State, Zip ____________________________________

Social Security No. _____________________

Email Address ____________________________________

Gender

Female

Male

(Only if you want your employee to have paystub access online)

Pay Frequency _______________ (list only if

If hired in the last 20 days, would you like New Hire Reporting on this

multiple pay frequencies for company)

employee? Yes

No

Direct Deposit Information (Max. of 2 Accounts)

Account #1

Direct Deposit to Checking

Attach a voided check from the employee’s checking account

Direct Deposit to Savings Routing#______________________Acct#____________________________Amount$________

Dollar amount only

No percentage

Account#2 (if applicable – both accounts must be Bank of America accounts for this option)

Direct Deposit to Checking

Attach a voided check from the employee’s checking account

Direct Deposit to Savings Routing#______________________ Acct#____________________________Amount: Remainder

Tax Information

Federal Withholding Status - Specify below or attach a W-4 form

Single Married Head of Household Do Not Withhold

# Of Allowances ______ Any Additional Withholding ______________

State Withholding Status - Specify below or attach a State withholding form

(

Please verify with your state regarding

)

separate withholding information

Single Married Head of Household Do Not Withhold

Local taxes?

Yes No

Do not withhold

# Of Allowances ______ Any Additional Withholding ______________

Specify any situations that an employee may have tax exemptions such as Minor Children, Visa employees, Clergy, etc.

________________________________________________________________________________________

Which types of pay does this employee receive?

Bonus

Salary $____________ per paycheck

Cash Tips

Non Taxable Per Diem

Hourly $____________ per hour

Paycheck Tips

S-Corp Owners Health Ins.

nd

2

hourly rate $_______ per hour

Clergy Housing (Cash)

Company HSA Contrib.(pretax)

Overtime Pay

Clergy Housing (In-Kind)

Allowance (specify)

Double Overtime

Personal Use of Company

Other Earnings (specify)

Holiday Pay

Car

Name:___________________

Reimbursement

Commission

4

1

1 2

2