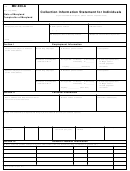

Section 6.

Other Personal Assets

18. Other Assets (Include all assets listed on homeowners insurance policy)

Current

Liabilities

Equity

Amount of

Date of

Description

Market

Balance

In

Monthly

Name and Address of

Date

Final

Value

Due

Asset

Payment

Lien/Note Holder/Obligee

Pledged

Payment

18a.

18b.

18c .

18d. Total Current Fair Market Value

18e. Total Current Loan Balance

18f. Net Equity

Section 7.

Judgments & Secured Liens (other secured debts)

19. Other Liabilities (Include judgments and any secured debt)

Liabilities

Amount of

Date of

Description

Balance

Monthly

Name and Address of

Date

Final

Due

Payment

Lien/Note Holder/Obligee

Pledged

Payment

19a. IRS

19b.

19c.

19d.

Total Liabilities

Balance Due

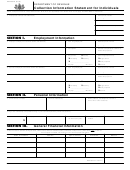

Section 8.

Notes, Charge Accounts and Medical Expenses

20. Available Credit (list bank charge cards, credit unions, lines of credit, medical expenses)

Type of Account

Name and Address of

Monthly

Credit

Amount

Credit

or Card

Financial Institution

Payment

Limit

Owed

Available

20a.

20b.

20c.

20d.

20e. Total Credit Available

Section 9.

Other Financial Information

21. Other information relating to your financial condition. If you check the yes box, please give dates and explain under remarks.

a. Court proceedings

Yes

No

b. Bankruptcies

Yes

No

Remarks:

Remarks:

c. Repossessions

Yes

No

d. Recent transfer of assets

Yes

No

for less than full value

Remarks:

Remarks:

e. Anticipated increase in income

Yes

No

f. Participant or beneficiary to trust,

Yes

No

estate, profit sharing, etc.

Remarks:

Remarks:

g. Do you receive government assistance

h. Are all required state tax returns filed?

based on disability and/or financial need?

Yes

No

Yes

No

Remarks:

Remarks:

Form RO-1062 page 3 (Rev. 4-10)

1

1 2

2 3

3 4

4 5

5 6

6