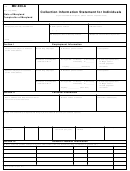

Business Assets. Include all tools, books, machinery, equipment, inventory or other assets used in trade or business. Include Uniform

Commercial Code (UCC) filings. Include Vehicles and Real Property owned/leased/rented by the business, if not shown in Section 10.

Current Fair

Amount of

Date of Final

Purchase/Lease/Rental

Market Value

Current Loan

Monthly

Payment

Equity

Date (mm/dd/yyyy)

(FMV)

Balance

Payment

(mm/dd/yyyy)

FMV Minus Loan

61a. Property Description

$

Location (Street, City, State, ZIP code) and County

Lender/Lessor/Landlord Name, Address (Street, City, State, ZIP code) and Phone

61b. Property Description

$

Location (Street, City, State, ZIP code) and County

Lender/Lessor/Landlord Name, Address (Street, City, State, ZIP code) and Phone

61c. Total Equity (Add lines 61a, 61b and amounts from any attachments

$

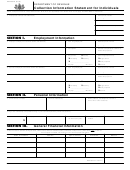

Section 12 must be completed only if the taxpayer is SELF-EMPLOYED

Section 12.

Sole Proprietorship Information

(lines 62 through 83 should reconcile with business Profit and Loss Statement)

Accounting Method Used:

Cash

Accrual

Income and Expenses during the period (mm/dd/yyyy)

to (mm/dd/yyyy)

Total Monthly Business Income

Source

Gross Monthly

Expense Items

Actual Monthly

62. Gross Receipts

72. Materials Purchased

63. Gross Rental Income

73. Inventory Purchased

64. Interest

74. Gross Wages & Salaries

65. Dividends

75. Rent

66. Cash

76. Supplies

Other Income (Specify Below)

77. Utilities/Telephone

67

78. Vehicle Gasoline/Oil

68

79. Repairs & Maintenance

69

80. Insurance

70

81. Current Taxes

82. Other Expenses,

including installment payments

71. Total Income

83. Total Expenses (Add lines 72 through 82)

Add lines 62 through 70

84. Net Business Income (line 71 minus 83)

Enter the amount from line 84 on line 32, Section 10. If line 84 is a loss, enter "0" on line 32, Section 10.

Self-employed taxpayers must return to page 4 to sign the certification and include all applicable attachments.

Materials Purchased: Materials are items directly related to the

Current Taxes: Real estate, state, and local income tax, excise,

production of a product or service.

franchise, occupational, personal property, sales and the employer's

portion of the employment taxes.

Inventory Purchased: Goods bought for resale.

Net Business Income: Net profit from Form 1040, Schedule C may

Supplies: Supplies are items used to conduct business and are consumed

be used if duplicated deductions are eliminated (e.g., expenses for

or used up within one year. This could be the cost of books, office

business use of home already included in housing and utility expenses

supplies, professional equipment, etc.

on page 4). Deductions for depreciation and depletion on Schedule C

are not cash expenses and must be added back to the net income

Utilities/Telephone: Utilities include gas, electricity, water, oil,

figure. In addition, interest cannot be deducted if it is already included

other fuels, trash collection, telephone and cell phone.

in any other installment payments allowed.

FINANCIAL ANALYSIS OF COLLECTION POTENTIAL

FOR INDIVIDUAL WAGE EARNERS AND SELF-EMPLOYED INDIVIDUALS

(DOR USE ONLY)

Cash Available

(Lines 12, 13e, 14d, 15c, 20e, 58, 59c, 60e)

Total Cash

$

Distrainable Asset Summary

(Lines 16e, 17e, 18f, 61c)

Total Equity

$

Monthly Total Positive Income minus Expenses

(Line 35 minus Line 47)

Monthly Available Cash

$

Form RO-1062 page 6 (Rev. 4-10)

1

1 2

2 3

3 4

4 5

5 6

6