Form Cit-5 - New Mexico Qualified Business Facility Rehabilitation Credit - 2009

ADVERTISEMENT

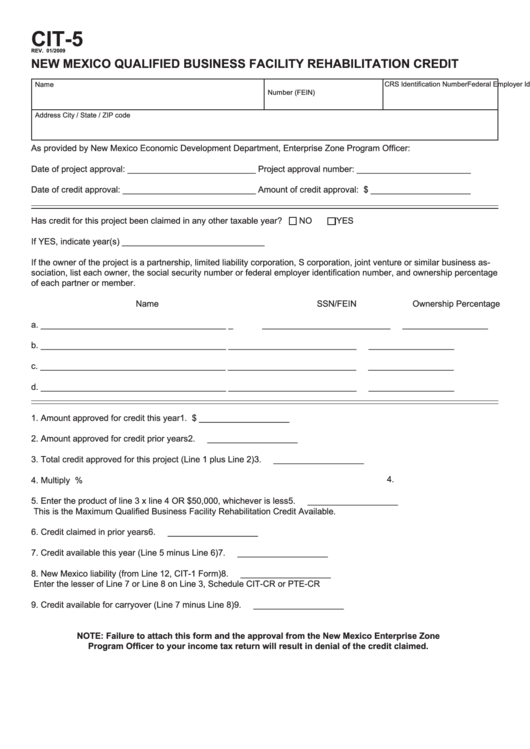

CIT-5

REV. 01/2009

NEW MEXICO QUALIFIED BUSINESS FACILITY REHABILITATION CREDIT

Name

Federal Employer Identification

CRS Identification Number

Number (FEIN)

Address

City / State / ZIP code

As provided by New Mexico Economic Development Department, Enterprise Zone Program Officer:

Date of project approval: ___________________________

Project approval number: ________________________

Date of credit approval: ____________________________

Amount of credit approval: $ _____________________

Has credit for this project been claimed in any other taxable year?

NO

YES

If YES, indicate year(s) ______________________________

If the owner of the project is a partnership, limited liability corporation, S corporation, joint venture or similar business as-

sociation, list each owner, the social security number or federal employer identification number, and ownership percentage

of each partner or member.

Name

SSN/FEIN

Ownership Percentage

a. _______________________________________ _

___________________________

__________________

b. _______________________________________

___________________________

__________________

c. _______________________________________

___________________________

__________________

d. _______________________________________

___________________________

__________________

1. Amount approved for credit this year .................................................................................. 1. $ ___________________

2. Amount approved for credit prior years ............................................................................... 2.

___________________

3. Total credit approved for this project (Line 1 plus Line 2) ................................................... 3.

___________________

4.

4. Multiply by............................................................................................................................

50%

5. Enter the product of line 3 x line 4 OR $50,000, whichever is less ..................................... 5.

___________________

This is the Maximum Qualified Business Facility Rehabilitation Credit Available.

6. Credit claimed in prior years ............................................................................................... 6.

___________________

7. Credit available this year (Line 5 minus Line 6) .................................................................. 7.

___________________

8. New Mexico liability (from Line 12, CIT-1 Form) ................................................................. 8.

___________________

Enter the lesser of Line 7 or Line 8 on Line 3, Schedule CIT-CR or PTE-CR

9. Credit available for carryover (Line 7 minus Line 8) ........................................................... 9.

___________________

NOTE: Failure to attach this form and the approval from the New Mexico Enterprise Zone

Program Officer to your income tax return will result in denial of the credit claimed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1