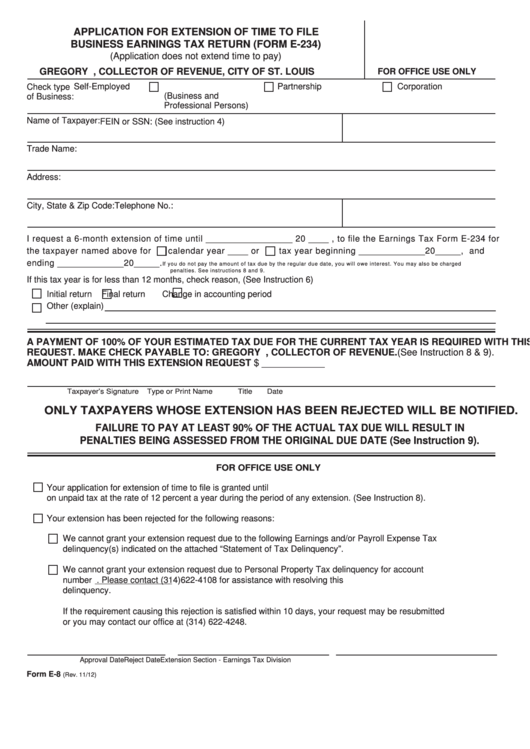

APPLICATION FOR EXTENSION OF TIME TO FILE

BUSINESS EARNINGS TAX RETURN (FORM E-234)

(Application does not extend time to pay)

GREGORY F.X. DALY, COLLECTOR OF REVENUE, CITY OF ST. LOUIS

FOR OFFICE USE ONLY

Self-Employed

Partnership

Corporation

Check type

(Business and

of Business:

Professional Persons)

Name of Taxpayer:

FEIN or SSN: (See instruction 4)

Trade Name:

Address:

City, State & Zip Code:

Telephone No.:

I request a 6-month extension of time until _________________ 20 ____ , to file the Earnings Tax Form E-234 for

the taxpayer named above for

calendar year ____ or

tax year beginning _____________20_____, and

ending _____________20_____.

If you do not pay the amount of tax due by the regular due date, you will owe interest. You may also be charged

penalties. See instructions 8 and 9.

If this tax year is for less than 12 months, check reason, (See Instruction 6)

Initial return

Final return

Change in accounting period

Other (explain)

A PAYMENT OF 100% OF YOUR ESTIMATED TAX DUE FOR THE CURRENT TAX YEAR IS REQUIRED WITH THIS

REQUEST. MAKE CHECK PAYABLE TO: GREGORY F.X. DALY, COLLECTOR OF REVENUE. (See Instruction 8 & 9).

AMOUNT PAID WITH THIS EXTENSION REQUEST .................................................................................. $ ____________

Taxpayer’s Signature

Type or Print Name

Title

Date

ONLY TAXPAYERS WHOSE EXTENSION HAS BEEN REJECTED WILL BE NOTIFIED.

FAILURE TO PAY AT LEAST 90% OF THE ACTUAL TAX DUE WILL RESULT IN

PENALTIES BEING ASSESSED FROM THE ORIGINAL DUE DATE (See Instruction 9).

FOR OFFICE USE ONLY

Your application for extension of time to file is granted until ................................................20 ........ . Interest accrues

on unpaid tax at the rate of 12 percent a year during the period of any extension. (See Instruction 8).

Your extension has been rejected for the following reasons:

We cannot grant your extension request due to the following Earnings and/or Payroll Expense Tax

delinquency(s) indicated on the attached “Statement of Tax Delinquency”.

We cannot grant your extension request due to Personal Property Tax delinquency for account

number

. Please contact (314) 622-4108 for assistance with resolving this

delinquency.

If the requirement causing this rejection is satisfied within 10 days, your request may be resubmitted

or you may contact our office at (314) 622-4248.

Approval Date

Reject Date

Extension Section - Earnings Tax Division

Form E-8

(Rev. 11/12)

1

1