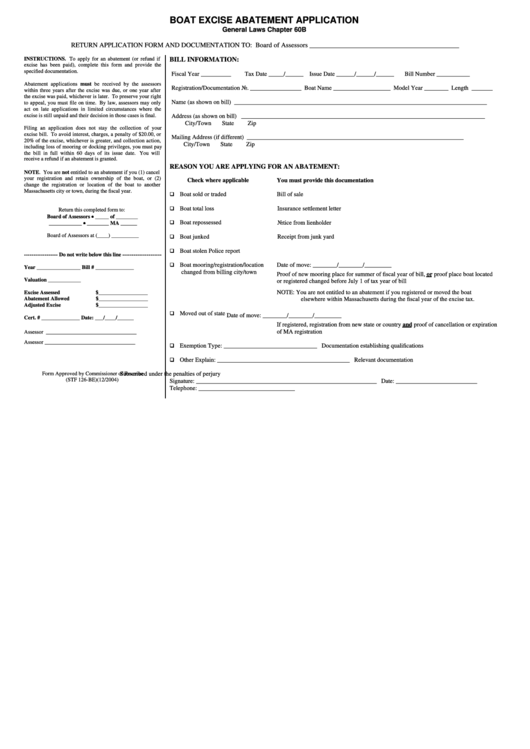

BOAT EXCISE ABATEMENT APPLICATION

General Laws Chapter 60B

RETURN APPLICATION FORM AND DOCUMENTATION TO: Board of Assessors ____________________________________________

INSTRUCTIONS. To apply for an abatement (or refund if

BILL INFORMATION:

excise has been paid), complete this form and provide the

specified documentation.

Fiscal Year __________

Tax Date _____/______ Issue Date ______/______/______

Bill Number ___________

Abatement applications must be received by the assessors

Registration/Documentation No. _________________ Boat Name ___________________ Model Year ________ Length _______

within three years after the excise was due, or one year after

the excise was paid, whichever is later. To preserve your right

Name (as shown on bill) ____________________________________________________________________________________

to appeal, you must file on time. By law, assessors may only

act on late applications in limited circumstances where the

excise is still unpaid and their decision in those cases is final.

Address (as shown on bill) _________________________________________________________________________________

City/Town

State

Zip

Filing an application does not stay the collection of your

excise bill. To avoid interest, charges, a penalty of $20.00, or

Mailing Address (if different) ________________________________________________________________________

20% of the excise, whichever is greater, and collection action,

City/Town

State

Zip

including loss of mooring or docking privileges, you must pay

the bill in full within 60 days of its issue date. You will

receive a refund if an abatement is granted.

REASON YOU ARE APPLYING FOR AN ABATEMENT:

NOTE. You are not entitled to an abatement if you (1) cancel

your registration and retain ownership of the boat, or (2)

Check where applicable

You must provide this documentation

change the registration or location of the boat to another

Massachusetts city or town, during the fiscal year.

Boat sold or traded

Bill of sale

Boat total loss

Insurance settlement letter

Return this completed form to:

Board of Assessors • _____ of ________

____________ • ________ MA ______

Boat repossessed

Notice from lienholder

Board of Assessors at (____) __________

Boat junked

Receipt from junk yard

Boat stolen

Police report

------------------ Do not write below this line ---------------------

Boat mooring/registration/location

Date of move: ________/________/_________

Year ________________

Bill # ______________

changed from billing city/town

Proof of new mooring place for summer of fiscal year of bill, or proof place boat located

Valuation ____________

or registered changed before July 1 of tax year of bill

NOTE:

You are not entitled to an abatement if you registered or moved the boat

Excise Assessed

$__________________

Abatement Allowed

$__________________

elsewhere within Massachusetts during the fiscal year of the excise tax.

Adjusted Excise

$__________________

Moved out of state

Date of move: ________/________/_________

Cert. # ______________

Date: ___/____/______

If registered, registration from new state or country and proof of cancellation or expiration

of MA registration

Assessor _________________________________

Assessor _________________________________

Exemption

Type: _______________________________ Documentation establishing qualifications

Other

Explain: ____________________________________________ Relevant documentation

Form Approved by Commissioner of Revenue

Subscribed under the penalties of perjury

(STF 126-BE)(12/2004)

Signature: ____________________________________________________________ Date: ___________________________

Telephone: ________________________________

1

1