Personal Property Proration Form - Charleston County Auditor'S Office

ADVERTISEMENT

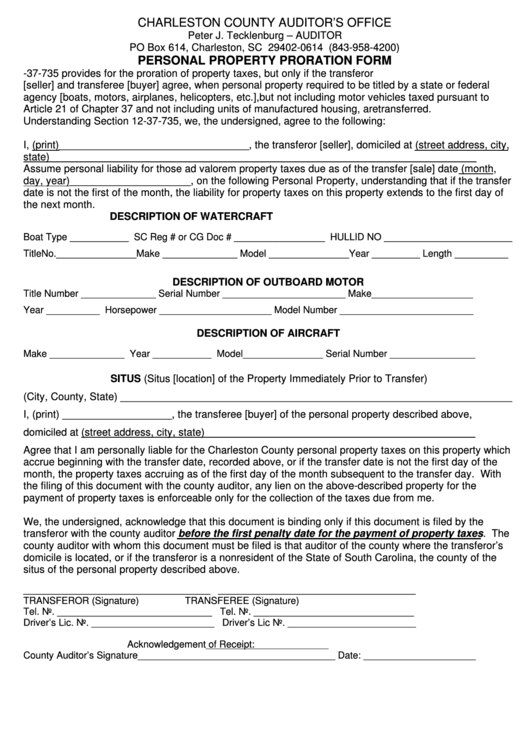

CHARLESTON COUNTY AUDITOR’S OFFICE

Peter J. Tecklenburg – AUDITOR

PO Box 614, Charleston, SC 29402-0614 (843-958-4200)

PERSONAL PROPERTY PRORATION FORM

S.C. Code Ann. Section 12-37-735 provides for the proration of property taxes, but only if the transferor

[seller] and transferee [buyer] agree, when personal property required to be titled by a state or federal

agency [boats, motors, airplanes, helicopters, etc.], but not including motor vehicles taxed pursuant to

Article 21 of Chapter 37 and not including units of manufactured housing, are transferred.

Understanding Section 12-37-735, we, the undersigned, agree to the following:

I, (print)_________________________________, the transferor [seller], domiciled at (street address, city,

state)__________________________________________________________________________

Assume personal liability for those ad valorem property taxes due as of the transfer [sale] date (month,

day, year)_____________________, on the following Personal Property, understanding that if the transfer

date is not the first of the month, the liability for property taxes on this property extends to the first day of

the next month.

DESCRIPTION OF WATERCRAFT

Boat Type ___________ SC Reg # or CG Doc # _________________ HULL ID NO ________________________

TitleNo._______________ Make ______________ Model _______________ Year _________ Length __________

DESCRIPTION OF OUTBOARD MOTOR

Title Number ______________ Serial Number _______________________ Make___________________

Year __________ Horsepower _____________________ Model Number _________________________

DESCRIPTION OF AIRCRAFT

Make ______________ Year ___________ Model_______________ Serial Number ________________

SITUS (Situs [location] of the Property Immediately Prior to Transfer)

(City, County, State) ____________________________________________________________________

I, (print) ___________________, the transferee [buyer] of the personal property described above,

domiciled at (street address, city, state)_______________________________________________

Agree that I am personally liable for the Charleston County personal property taxes on this property which

accrue beginning with the transfer date, recorded above, or if the transfer date is not the first day of the

month, the property taxes accruing as of the first day of the month subsequent to the transfer day. With

the filing of this document with the county auditor, any lien on the above-described property for the

payment of property taxes is enforceable only for the collection of the taxes due from me.

We, the undersigned, acknowledge that this document is binding only if this document is filed by the

transferor with the county auditor before the first penalty date for the payment of property taxes. The

county auditor with whom this document must be filed is that auditor of the county where the transferor’s

domicile is located, or if the transferor is a nonresident of the State of South Carolina, the county of the

situs of the personal property described above.

___________________________________

_____________________________________

TRANSFEROR (Signature)

TRANSFEREE (Signature)

Tel. No. _____________________________

Tel. No. ______________________________

Driver’s Lic. No. _______________________

Driver’s Lic No. ________________________

Acknowledgement of Receipt:

County Auditor’s Signature_____________________________________ Date: _____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1