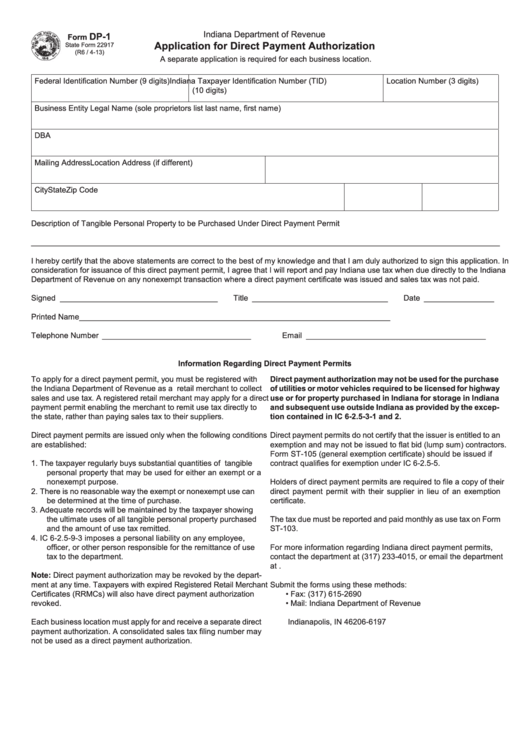

Indiana Department of Revenue

DP-1

Form

Application for Direct Payment Authorization

State Form 22917

(R6 / 4-13)

A separate application is required for each business location.

Federal Identification Number (9 digits)

Indiana Taxpayer Identification Number (TID)

Location Number (3 digits)

(10 digits)

Business Entity Legal Name (sole proprietors list last name, first name)

DBA

Mailing Address

Location Address (if different)

City

State

Zip Code

Description of Tangible Personal Property to be Purchased Under Direct Payment Permit

___________________________________________________________________________________________________________

I hereby certify that the above statements are correct to the best of my knowledge and that I am duly authorized to sign this application. In

consideration for issuance of this direct payment permit, I agree that I will report and pay Indiana use tax when due directly to the Indiana

Department of Revenue on any nonexempt transaction where a direct payment certificate was issued and sales tax was not paid.

Signed ____________________________________

Title _______________________________

Date ________________

Printed Name _______________________________________________________________________

Telephone Number __________________________________

Email _________________________________________

Information Regarding Direct Payment Permits

To apply for a direct payment permit, you must be registered with

Direct payment authorization may not be used for the purchase

the Indiana Department of Revenue as a retail merchant to collect

of utilities or motor vehicles required to be licensed for highway

sales and use tax. A registered retail merchant may apply for a direct

use or for property purchased in Indiana for storage in Indiana

and subsequent use outside Indiana as provided by the excep-

payment permit enabling the merchant to remit use tax directly to

the state, rather than paying sales tax to their suppliers.

tion contained in IC 6-2.5-3-1 and 2.

Direct payment permits are issued only when the following conditions

Direct payment permits do not certify that the issuer is entitled to an

are established:

exemption and may not be issued to flat bid (lump sum) contractors.

Form ST-105 (general exemption certificate) should be issued if

1.

The taxpayer regularly buys substantial quantities of tangible

contract qualifies for exemption under IC 6-2.5-5.

personal property that may be used for either an exempt or a

nonexempt purpose.

Holders of direct payment permits are required to file a copy of their

2.

There is no reasonable way the exempt or nonexempt use can

direct payment permit with their supplier in lieu of an exemption

be determined at the time of purchase.

certificate.

3.

Adequate records will be maintained by the taxpayer showing

the ultimate uses of all tangible personal property purchased

The tax due must be reported and paid monthly as use tax on Form

and the amount of use tax remitted.

ST-103.

4.

IC 6-2.5-9-3 imposes a personal liability on any employee,

officer, or other person responsible for the remittance of use

For more information regarding Indiana direct payment permits,

tax to the department.

contact the department at (317) 233-4015, or email the department

at

Note: Direct payment authorization may be revoked by the depart-

ment at any time. Taxpayers with expired Registered Retail Merchant

Submit the forms using these methods:

Certificates (RRMCs) will also have direct payment authorization

•

Fax:

(317) 615-2690

revoked.

•

Mail: Indiana Department of Revenue

P.O. Box 6197

Each business location must apply for and receive a separate direct

Indianapolis, IN 46206-6197

payment authorization. A consolidated sales tax filing number may

not be used as a direct payment authorization.

1

1