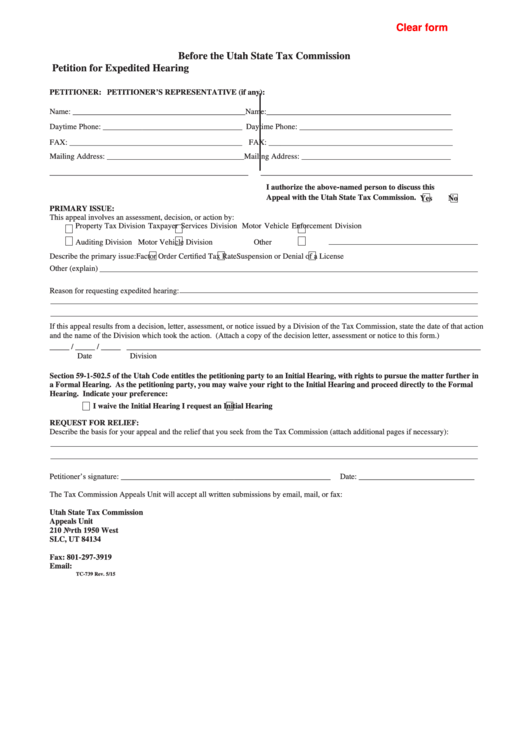

Clear form

Before the Utah State Tax Commission

Petition for Expedited Hearing

PETITIONER:

PETITIONER’S REPRESENTATIVE (if any):

Name: ____________________________________________

Name:_______________________________________________

Daytime Phone: ____________________________________

Daytime Phone: _______________________________________

FAX: ____________________________________________

FAX: _______________________________________________

Mailing Address: ___________________________________

Mailing Address: ______________________________________

_____________________________________________

________________________________________________

-

I authorize the above

named person to discuss this

Appeal with the Utah State Tax Commission.

Yes

No

PRIMARY ISSUE:

This appeal involves an assessment, decision, or action by:

Property Tax Division

Taxpayer Services Division

Motor Vehicle Enforcement Division

Auditing Division

Motor Vehicle Division

Other

Describe the primary issue:

Factor Order

Certified Tax Rate

Suspension or Denial of a License

Other (explain)

Reason for requesting expedited hearing:

If this appeal results from a decision, letter, assessment, or notice issued by a Division of the Tax Commission, state the date of that action

and the name of the Division which took the action. (Attach a copy of the decision letter, assessment or notice to this form.)

_____ / _____ / _____ __________________________________________________________________________________________

Date

Division

Section 59-1-502.5 of the Utah Code entitles the petitioning party to an Initial Hearing, with rights to pursue the matter further in

a Formal Hearing. As the petitioning party, you may waive your right to the Initial Hearing and proceed directly to the Formal

Hearing. Indicate your preference:

I waive the Initial Hearing

I request an Initial Hearing

REQUEST FOR RELIEF:

Describe the basis for your appeal and the relief that you seek from the Tax Commission (attach additional pages if necessary):

Petitioner’s signature: ______________________________________________________

Date: ______________________________

The Tax Commission Appeals Unit will accept all written submissions by email, mail, or fax:

Utah State Tax Commission

Appeals Unit

210 North 1950 West

SLC, UT 84134

Fax: 801-297-3919

Email: taxappeals@utah.gov

TC-739 Rev. 5/15

1

1