Declaration Of Value Form

Download a blank fillable Declaration Of Value Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Declaration Of Value Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

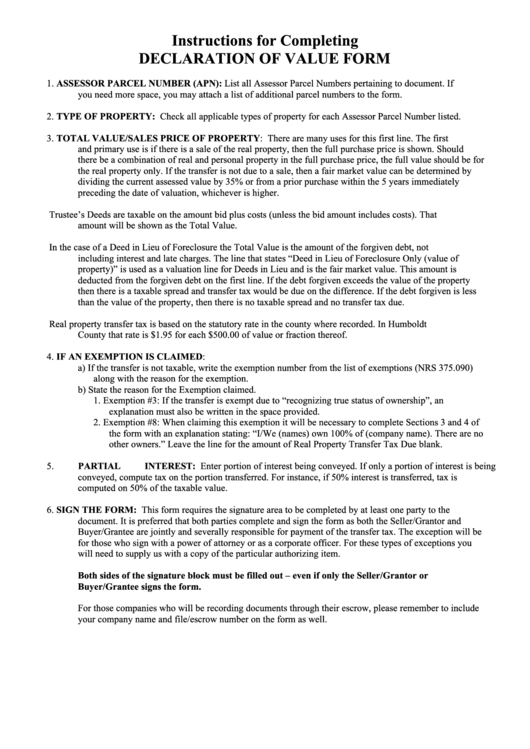

Instructions for Completing

DECLARATION OF VALUE FORM

1.

ASSESSOR PARCEL NUMBER (APN): List all Assessor Parcel Numbers pertaining to document. If

you need more space, you may attach a list of additional parcel numbers to the form.

2.

TYPE OF PROPERTY: Check all applicable types of property for each Assessor Parcel Number listed.

3.

TOTAL VALUE/SALES PRICE OF PROPERTY: There are many uses for this first line. The first

and primary use is if there is a sale of the real property, then the full purchase price is shown. Should

there be a combination of real and personal property in the full purchase price, the full value should be for

the real property only. If the transfer is not due to a sale, then a fair market value can be determined by

dividing the current assessed value by 35% or from a prior purchase within the 5 years immediately

preceding the date of valuation, whichever is higher.

Trustee’s Deeds are taxable on the amount bid plus costs (unless the bid amount includes costs). That

amount will be shown as the Total Value.

In the case of a Deed in Lieu of Foreclosure the Total Value is the amount of the forgiven debt, not

including interest and late charges. The line that states “Deed in Lieu of Foreclosure Only (value of

property)” is used as a valuation line for Deeds in Lieu and is the fair market value. This amount is

deducted from the forgiven debt on the first line. If the debt forgiven exceeds the value of the property

then there is a taxable spread and transfer tax would be due on the difference. If the debt forgiven is less

than the value of the property, then there is no taxable spread and no transfer tax due.

Real property transfer tax is based on the statutory rate in the county where recorded. In Humboldt

County that rate is $1.95 for each $500.00 of value or fraction thereof.

4.

IF AN EXEMPTION IS CLAIMED:

a) If the transfer is not taxable, write the exemption number from the list of exemptions (NRS 375.090)

along with the reason for the exemption.

b) State the reason for the Exemption claimed.

1. Exemption #3: If the transfer is exempt due to “recognizing true status of ownership”, an

explanation must also be written in the space provided.

2. Exemption #8: When claiming this exemption it will be necessary to complete Sections 3 and 4 of

the form with an explanation stating: “I/We (names) own 100% of (company name). There are no

other owners.” Leave the line for the amount of Real Property Transfer Tax Due blank.

5.

PARTIAL INTEREST: Enter portion of interest being conveyed. If only a portion of interest is being

conveyed, compute tax on the portion transferred. For instance, if 50% interest is transferred, tax is

computed on 50% of the taxable value.

6.

SIGN THE FORM: This form requires the signature area to be completed by at least one party to the

document. It is preferred that both parties complete and sign the form as both the Seller/Grantor and

Buyer/Grantee are jointly and severally responsible for payment of the transfer tax. The exception will be

for those who sign with a power of attorney or as a corporate officer. For these types of exceptions you

will need to supply us with a copy of the particular authorizing item.

Both sides of the signature block must be filled out – even if only the Seller/Grantor or

Buyer/Grantee signs the form.

For those companies who will be recording documents through their escrow, please remember to include

your company name and file/escrow number on the form as well.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2