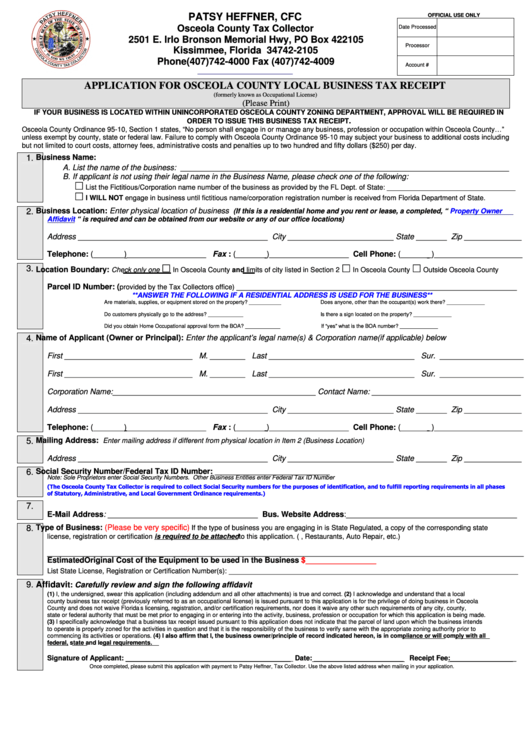

PATSY HEFFNER, CFC

OFFICIAL USE ONLY

Osceola County Tax Collector

Date Processed

2501 E. Irlo Bronson Memorial Hwy, PO Box 422105

Processor

Kissimmee, Florida 34742-2105

Phone(407)742-4000 Fax (407)742-4009

Account #

APPLICATION FOR OSCEOLA COUNTY LOCAL BUSINESS TAX RECEIPT

(formerly known as Occupational License)

(Please Print)

IF YOUR BUSINESS IS LOCATED WITHIN UNINCORPORATED OSCEOLA COUNTY ZONING DEPARTMENT, APPROVAL WILL BE REQUIRED IN

.

ORDER TO ISSUE THIS BUSINESS TAX RECEIPT

Osceola County Ordinance 95-10, Section 1 states, “No person shall engage in or manage any business, profession or occupation within Osceola County…”

unless exempt by county, state or federal law. Failure to comply with Osceola County Ordinance 95-10 may subject your business to additional costs including

but not limited to court costs, attorney fees, administrative costs and penalties up to two hundred and fifty dollars ($250) per day.

Business Name:

1.

A.

List the name of the business: ___________________________________________________________________________

B.

If applicant is not using their legal name in the Business Name, please check one of the following:

List the Fictitious/Corporation name number of the business as provided by the FL Dept. of State: _________________________________

I WILL NOT engage in business until fictitious name/corporation registration number is received from Florida Department of State.

2.

Business Location: Enter physical location of business

(If this is a residential home and you rent or lease, a completed, “

Property Owner

Affidavit

“ is required and can be obtained from our website or any of our office locations)

Address ___________________________________________ City ________________________ State _______ Zip _____________

Telephone: (_______)__________________ Fax : (_______)__________________ Cell Phone: (_______)____________________

3.

Location Boundary:

In Osceola County and limits of city listed in Section 2

In Osceola County

Outside Osceola County

Check only one

Parcel ID Number: (

________________________________________________________________

provided by the Tax Collectors office)

**ANSWER THE FOLLOWING IF A RESIDENTIAL ADDRESS IS USED FOR THE BUSINESS**

Are materials, supplies, or equipment stored on the property? ___________

Does anyone, other than the occupant(s) work there? _____________

Do customers physically go to the address? ____________

Is there a sign located on the property? _____________

Did you obtain Home Occupational approval form the BOA? ____________

If “yes” what is the BOA number? _____________

Name of Applicant (Owner or Principal): Enter the applicant’s legal name(s) & Corporation name(if applicable) below

4.

First _____________________________ M. ________ Last _________________________________ Sur. ___________________

First _____________________________ M. ________ Last _________________________________ Sur. ___________________

Corporation Name:______________________________________________ Contact Name: __________________________________

Address ___________________________________________ City ________________________ State _______ Zip _____________

Telephone: (_______)__________________ Fax : (_______)__________________ Cell Phone: (_______)____________________

5.

Mailing Address:

Enter mailing address if different from physical location in Item 2 (Business Location)

Address ___________________________________________ City ________________________ State _______ Zip _____________

6.

Social Security Number/Federal Tax ID Number: __________________________

Note: Sole Proprietors enter Social Security Numbers. Other Business Entities enter Federal Tax ID Number

(The Osceola County Tax Collector is required to collect Social Security numbers for the purposes of identification, and to fulfill reporting requirements in all phases

of Statutory, Administrative, and Local Government Ordinance requirements.)

7.

E-Mail Address: __________________________________ Bus. Website Address:_______________________________________

Type of Business:

(Please be very specific)

8.

If the type of business you are engaging in is State Regulated, a copy of the corresponding state

license, registration or certification is required to be attached to this application. (i.e. General Contractors, Restaurants, Auto Repair, etc.)

____________________________________________________________________________________________________________

Estimated Original Cost of the Equipment to be used in the Business

$________________

__________________________________________________________________

List State License, Registration or Certification Number(s):

9.

Affidavi

t: Carefully review and sign the following affidavit

(1) I, the undersigned, swear this application (including addendum and all other attachments) is true and correct. (2) I acknowledge and understand that a local

county business tax receipt (previously referred to as an occupational license) is issued pursuant to this application is for the privilege of doing business in Osceola

’

County and does not waive Florida

s licensing, registration, and/or certification requirements, nor does it waive any other such requirements of any city, county,

state or federal authority that must be met prior to engaging in or entering into the activity, business, profession or occupation for which this application is being made.

(3) I specifically acknowledge that a business tax receipt issued pursuant to this application does not indicate that the parcel of land upon which the business intends

to operate is properly zoned for the activities in question and that it is the responsibility of the business to verify same with the appropriate zoning authority prior to

commencing its activities or operations. (4) I also affirm that I, the business owner/principle of record indicated hereon, is in compliance or will comply with all

federal, state and legal requirements.

Signature of Applicant: ___________________________________________ Date: _______________________ Receipt Fee:_________________

Once completed, please submit this application with payment to Patsy Heffner, Tax Collector. Use the above listed address when mailing in your application.

1

1