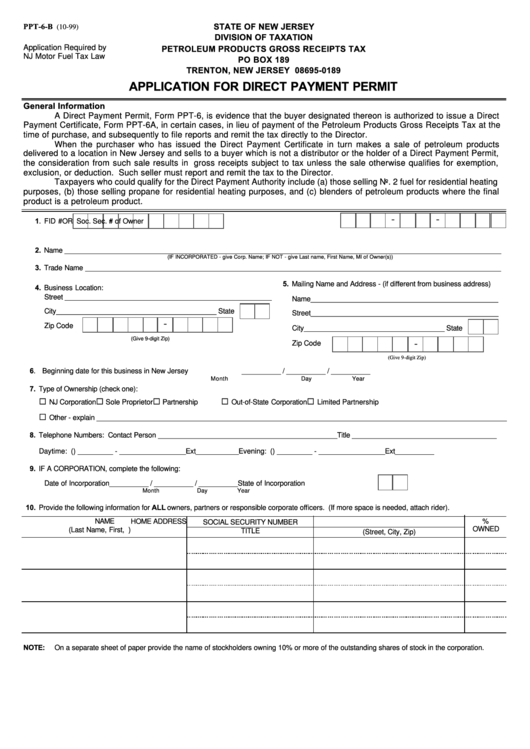

PPT-6-B

STATE OF NEW JERSEY

(10-99)

DIVISION OF TAXATION

PETROLEUM PRODUCTS GROSS RECEIPTS TAX

Application Required by

NJ Motor Fuel Tax Law

PO BOX 189

TRENTON, NEW JERSEY 08695-0189

APPLICATION FOR DIRECT PAYMENT PERMIT

General Information

A Direct Payment Permit, Form PPT-6, is evidence that the buyer designated thereon is authorized to issue a Direct

Payment Certificate, Form PPT-6A, in certain cases, in lieu of payment of the Petroleum Products Gross Receipts Tax at the

time of purchase, and subsequently to file reports and remit the tax directly to the Director.

When the purchaser who has issued the Direct Payment Certificate in turn makes a sale of petroleum products

delivered to a location in New Jersey and sells to a buyer which is not a distributor or the holder of a Direct Payment Permit,

the consideration from such sale results in gross receipts subject to tax unless the sale otherwise qualifies for exemption,

exclusion, or deduction. Such seller must report and remit the tax to the Director.

Taxpayers who could qualify for the Direct Payment Authority include (a) those selling No. 2 fuel for residential heating

purposes, (b) those selling propane for residential heating purposes, and (c) blenders of petroleum products where the final

product is a petroleum product.

-

-

-

1. FID #

OR Soc. Sec. # of Owner

2. Name ________________________________________________________________________________________________________________

(IF INCORPORATED - give Corp. Name; IF NOT - give Last name, First Name, MI of Owner(s))

3. Trade Name ___________________________________________________________________________________________________________

5. Mailing Name and Address - (if different from business address)

4. Business Location:

Street _____________________________________________________

Name________________________________________________

City_________________________________________ State

Street________________________________________________

-

Zip Code

City____________________________________ State

(Give 9-digit Zip)

-

Zip Code

(Give 9-digit Zip)

6. Beginning date for this business in New Jersey

__________ / __________ / __________

Month

Day

Year

7. Type of Ownership (check one):

¨

¨

¨

¨

¨

NJ Corporation

Sole Proprietor

Partnership

Out-of-State Corporation

Limited Partnership

¨

Other - explain _________________________________________________________________________________________________________

8. Telephone Numbers: Contact Person ______________________________________________

Title _____________________________________

Daytime: (

) _________ - _________________Ext___________

Evening: (

) _________ - _________________Ext__________

9. IF A CORPORATION, complete the following:

Date of Incorporation

__________ / __________ / __________

State of Incorporation

Month

Day

Year

10. Provide the following information for ALL owners, partners or responsible corporate officers. (If more space is needed, attach rider).

NAME

HOME ADDRESS

%

SOCIAL SECURITY NUMBER

OWNED

(Last Name, First, M.I.)

TITLE

(Street, City, Zip)

NOTE:

On a separate sheet of paper provide the name of stockholders owning 10% or more of the outstanding shares of stock in the corporation.

1

1 2

2