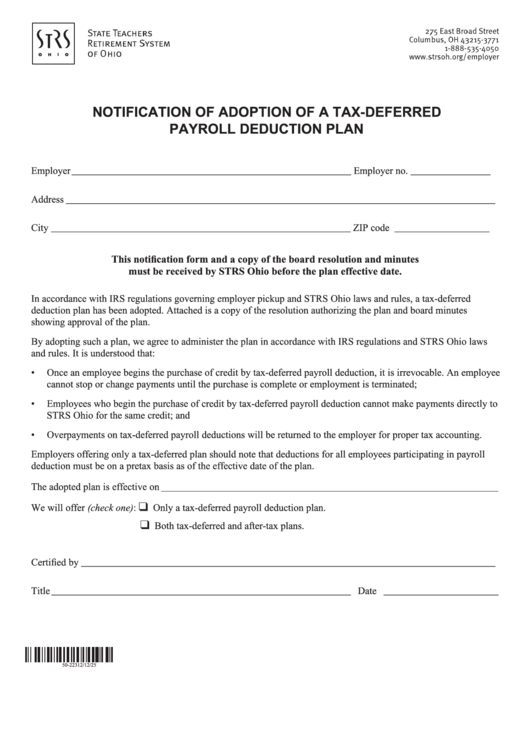

NOTIFICATION OF ADOPTION OF A TAX-DEFERRED

PAYROLL DEDUCTION PLAN

Employer ________________________________________________________ Employer no. ________________

Address ______________________________________________________________________________________

City ____________________________________________________________ ZIP code ___________________

This notification form and a copy of the board resolution and minutes

must be received by STRS Ohio before the plan effective date.

In accordance with IRS regulations governing employer pickup and STRS Ohio laws and rules, a tax-deferred

deduction plan has been adopted. Attached is a copy of the resolution authorizing the plan and board minutes

showing approval of the plan.

By adopting such a plan, we agree to administer the plan in accordance with IRS regulations and STRS Ohio laws

and rules. It is understood that:

•

Once an employee begins the purchase of credit by tax-deferred payroll deduction, it is irrevocable. An employee

cannot stop or change payments until the purchase is complete or employment is terminated;

•

Employees who begin the purchase of credit by tax-deferred payroll deduction cannot make payments directly to

STRS Ohio for the same credit; and

•

Overpayments on tax-deferred payroll deductions will be returned to the employer for proper tax accounting.

Employers offering only a tax-deferred plan should note that deductions for all employees participating in payroll

deduction must be on a pretax basis as of the effective date of the plan.

The adopted plan is effective on

q

We will offer (check one):

Only a tax-deferred payroll deduction plan.

q

Both tax-deferred and after-tax plans.

Certified by ___________________________________________________________________________________

Title ____________________________________________________________ Date _______________________

50-223

12/12/25

1

1