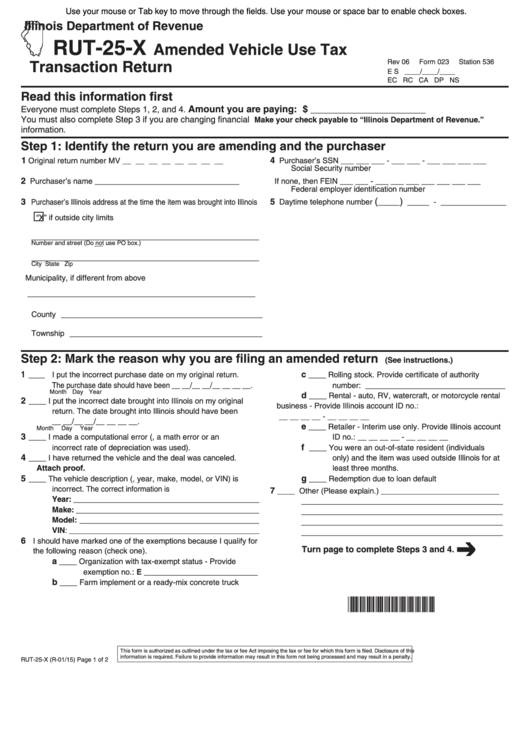

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RUT-25-X

Amended Vehicle Use Tax

Transaction Return

Rev 06

Form 023

Station 536

E S ____/____/____

EC RC CA DP NS

Read this information first

Amount you are paying: $ ______________________

Everyone must complete Steps 1, 2, and 4.

You must also complete Step 3 if you are changing financial

Make your check payable to “Illinois Department of Revenue.”

information.

Step 1: Identify the return you are amending and the purchaser

1

4

Purchaser’s SSN

___ ___ ___ - ___ ___ - ___ ___ ___ ___

Original return number MV __ __ __ __ __ __ __ __

Social Security number

2

Purchaser’s name

_________________________________

If none, then FEIN

___ ___ - ___ ___ ___ ___ ___ ___ ___

Federal employer identification number

(

)

3

5

Purchaser’s Illinois address at the time the item was brought into Illinois

Daytime telephone number

_____

_____ - _______________

“X” if outside city limits

____________________________________________________

Number and street (Do not use PO box.)

____________________________________________________

City

State Zip

Municipality, if different from above

____________________________________________________

County ______________________________________________

Township ____________________________________________

Step 2: Mark the reason why you are filing an amended return

(See instructions.)

1

c

____ I put the incorrect purchase date on my original return.

____ Rolling stock. Provide certificate of authority

The purchase date should have been __ __/__ __/__ __ __ __.

number: ________________________________

Month Day

Year

d

____ Rental - auto, RV, watercraft, or motorcycle rental

2

____ I put the incorrect date brought into Illinois on my original

business - Provide Illinois account ID no.:

return. The date brought into Illinois should have been

__ __ __ __ - __ __ __ __

__ __/__ __/__ __ __ __.

e

____ Retailer - Interim use only. Provide Illinois account

Month

Day

Year

3

____ I made a computational error (e.g., a math error or an

ID no.: __ __ __ __ - __ __ __ __

f

____ You were an out-of-state resident (individuals

incorrect rate of depreciation was used).

4

____ I have returned the vehicle and the deal was canceled.

only) and the item was used outside Illinois for at

Attach proof.

least three months.

5

g

____ The vehicle description (i.e., year, make, model, or VIN) is

____ Redemption due to loan default

incorrect. The correct information is

7

____ Other (Please explain.) ___________________________

Year: __________________________________________

______________________________________________

Make: _________________________________________

______________________________________________

Model: _________________________________________

______________________________________________

VIN: ___________________________________________

______________________________________________

6

I should have marked one of the exemptions because I qualify for

Turn page to complete Steps 3 and 4.

the following reason (check one).

a

____ Organization with tax-exempt status - Provide

exemption no.: E __________________________

b

____ Farm implement or a ready-mix concrete truck

*502361110*

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

RUT-25-X (R-01/15)

Page 1 of 2

1

1 2

2