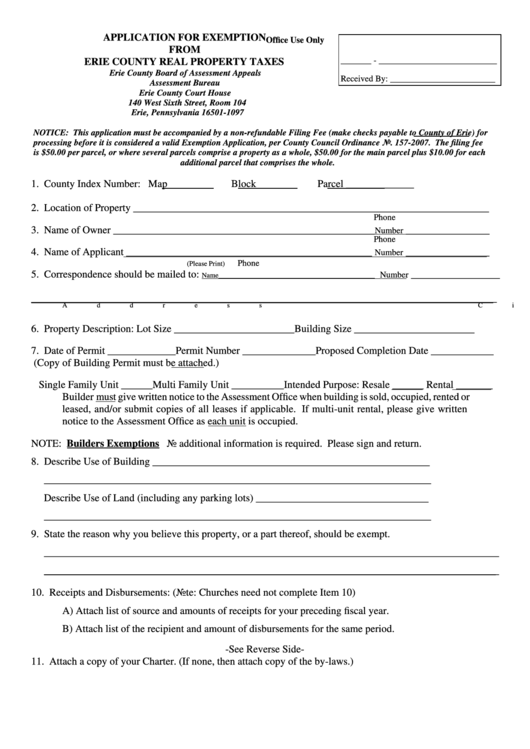

APPLICATION FOR EXEMPTION

Office Use Only

FROM

_______ - ___________________________

ERIE COUNTY REAL PROPERTY TAXES

I.D.

Erie County Board of Assessment Appeals

Received By: ________________________

Assessment Bureau

Erie County Court House

140 West Sixth Street, Room 104

Erie, Pennsylvania 16501-1097

NOTICE: This application must be accompanied by a non-refundable Filing Fee (make checks payable to County of Erie) for

processing before it is considered a valid Exemption Application, per County Council Ordinance No. 157-2007. The filing fee

is $50.00 per parcel, or where several parcels comprise a property as a whole, $50.00 for the main parcel plus $10.00 for each

additional parcel that comprises the whole.

1. County Index Number: I.D.

Map

Block

Parcel _____________

2. Location of Property ____________________________________________________________________

Phone

3. Name of Owner __________________________________________________

________________

Number

Phone

4. Name of Applicant _______________________________________________

________________

Number

Phone

(Please Print)

5. Correspondence should be mailed to:

_________________

Number

Name____________________________________________

_________________________________________________________________________________________

Address

City

State

Zip Code

6. Property Description:

Lot Size _______________________Building Size _______________________

7. Date of Permit _____________Permit Number ______________Proposed Completion Date ____________

(Copy of Building Permit must be attached.)

Single Family Unit ______Multi Family Unit __________Intended Purpose: Resale ______ Rental _______

Builder must give written notice to the Assessment Office when building is sold, occupied, rented or

leased, and/or submit copies of all leases if applicable. If multi-unit rental, please give written

notice to the Assessment Office as each unit is occupied.

NOTE: Builders Exemptions No additional information is required. Please sign and return.

8. Describe Use of Building _____________________________________________________

__________________________________________________________________________

Describe Use of Land (including any parking lots) _________________________________

__________________________________________________________________________

9. State the reason why you believe this property, or a part thereof, should be exempt.

_______________________________________________________________________________________

_______________________________________________________________________________________

10. Receipts and Disbursements: (Note: Churches need not complete Item 10)

A) Attach list of source and amounts of receipts for your preceding fiscal year.

B) Attach list of the recipient and amount of disbursements for the same period.

-See Reverse Side-

11. Attach a copy of your Charter. (If none, then attach copy of the by-laws.)

1

1 2

2