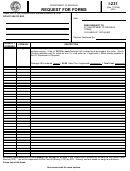

Form Pt-443 - Fee In Lieu Of Property Tax Initial Report Form - South Carolina Department Of Revenue Page 2

ADVERTISEMENT

20.

Initial Negotiated Millage

Fixed

Variable

Agreement page, para. §:

Rate

21.

Explanation, if necessary

22.

Calendar Year of Anticipated

Initial Investments

Agreement page, para. §:

23.

Length of Fee

Agreement page, para. §

(Number of Years)

24.

Payment Structure

Regular Payments

Equal Payments

5 Year Millage Adjustment

Agreement page, para. §:

Other (explain):

25.

Discount Rate

_______ %

Not Applicable

Agreement page, para. §:

Used for net present

value purposes

Disposal of Property?

Replacement of Property?

26.

Does Agreement Allow For

Agreement page, para. §

Yes

No

Yes

No

27.

Not Applicable

Min. No. of Jobs Required

Agreement page, para. §

(if applicable)

28.

Any additional information, allowances, or restrictions of which one must be aware to calculate or verify the fee under this

agreement:

Agreement page, para. §:

Agreement page, para. §:

Agreement page, para. §:

I declare that this return, to the best of my knowledge and belief, is true, correct, and complete.

Prepared by (please print):

Title:

Signature:

Date:

Telephone #:

E-mail Address:

Attachments:

Fully executed fee agreement or inducement agreement

Survey of real property under the fee (if available)

Inducement Resolution or other project identification.

Millage rate agreement (if applicable)

Any other attachments needed to respond to the questions.

The investor will need to file a supplemental form (form to be determined by the Department of Revenue) at the time that

the investor executes the lease agreement and/or places the property in service in this State.

70712013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2