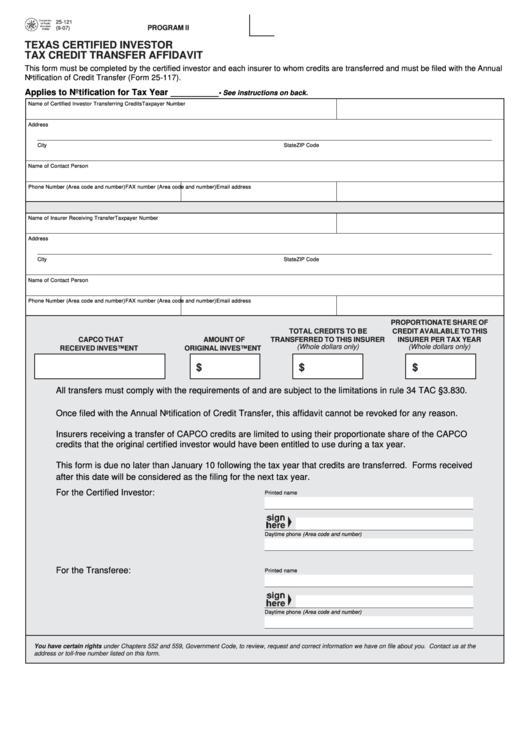

25-121

PROGRAM II

PRINT FORM

CLEAR FIELDS

(9-07)

TEXAS CERTIFIED INVESTOR

TAX CREDIT TRANSFER AFFIDAVIT

This form must be completed by the certified investor and each insurer to whom credits are transferred and must be filed with the Annual

Notification of Credit Transfer (Form 25-117).

Applies to Notification for Tax Year __________

• See instructions on back.

Name of Certified Investor Transferring Credits

Taxpayer Number

Address

City

State

ZIP Code

Name of Contact Person

Phone Number (Area code and number)

FAX number (Area code and number)

Email address

Name of Insurer Receiving Transfer

Taxpayer Number

Address

City

State

ZIP Code

Name of Contact Person

Phone Number (Area code and number)

FAX number (Area code and number)

Email address

PROPORTIONATE SHARE OF

TOTAL CREDITS TO BE

CREDIT AVAILABLE TO THIS

CAPCO THAT

AMOUNT OF

TRANSFERRED TO THIS INSURER

INSURER PER TAX YEAR

(Whole dollars only)

(Whole dollars only)

RECEIVED INVESTMENT

ORIGINAL INVESTMENT

$

$

$

All transfers must comply with the requirements of and are subject to the limitations in rule 34 TAC §3.830.

Once filed with the Annual Notification of Credit Transfer, this affidavit cannot be revoked for any reason.

Insurers receiving a transfer of CAPCO credits are limited to using their proportionate share of the CAPCO

credits that the original certified investor would have been entitled to use during a tax year.

This form is due no later than January 10 following the tax year that credits are transferred. Forms received

after this date will be considered as the filing for the next tax year.

For the Certified Investor:

Printed name

Daytime phone (Area code and number)

For the Transferee:

Printed name

Daytime phone (Area code and number)

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you. Contact us at the

address or toll-free number listed on this form.

1

1 2

2