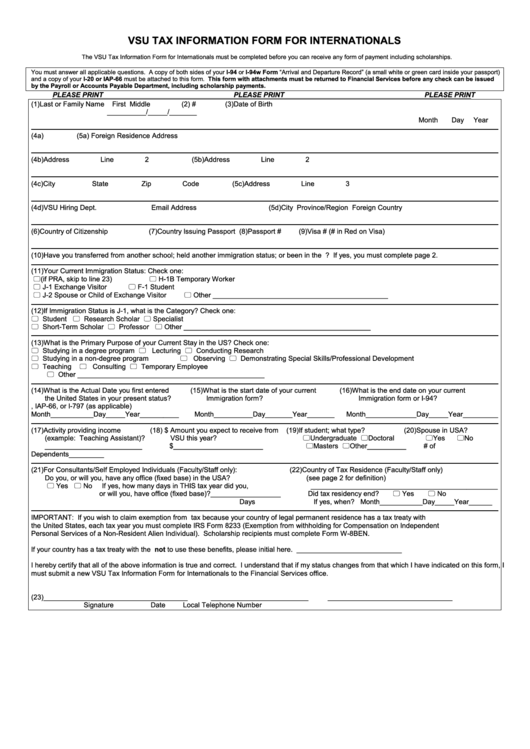

VSU TAX INFORMATION FORM FOR INTERNATIONALS

The VSU Tax Information Form for Internationals must be completed before you can receive any form of payment including scholarships.

You must answer all applicable questions. A copy of both sides of your I-94 or I-94w Form “Arrival and Departure Record” (a small white or green card inside your passport)

and a copy of your I-20 or IAP-66 must be attached to this form. This form with attachments must be returned to Financial Services before any check can be issued

by the Payroll or Accounts Payable Department, including scholarship payments.

PLEASE PRINT

PLEASE PRINT

PLEASE PRINT

(1)Last or Family Name

First

Middle

(2)U.S. Social Security #

(3)Date of Birth

__________/_____/_______

Month

Day

Year

(4a)U.S. Local Address

(5a) Foreign Residence Address

(4b)Address Line 2

(5b)Address Line 2

(4c)City

State

Zip Code

(5c)Address Line 3

(4d)VSU Hiring Dept.

Email Address

(5d)City

Province/Region

Foreign Country

(6)Country of Citizenship

(7)Country Issuing Passport

(8)Passport #

(9)Visa # (# in Red on Visa)

(10)Have you transferred from another school; held another immigration status; or been in the U.S. before? If yes, you must complete page 2.

(11)Your Current Immigration Status: Check one:

U.S. Immigrant/Permanent Resident Alien (if PRA, skip to line 23)

H-1B Temporary Worker

J-1 Exchange Visitor

F-1 Student

J-2 Spouse or Child of Exchange Visitor

Other _____________________________________________

(12)If Immigration Status is J-1, what is the Category? Check one:

Student

Research Scholar

Specialist

Short-Term Scholar

Professor

Other ________________________________________________

(13)What is the Primary Purpose of your Current Stay in the US? Check one:

Studying in a degree program

Lecturing

Conducting Research

Studying in a non-degree program

Observing

Demonstrating Special Skills/Professional Development

Teaching

Consulting

Temporary Employee

Other ________________________________________________

(14)What is the Actual Date you first entered

(15)What is the start date of your current

(16)What is the end date on your current

the United States in your present status?

Immigration form?

Immigration form or I-94?

i.e. I-20, IAP-66, or I-797 (as applicable)

Month___________Day_____Year__________

Month__________Day_______Year_______

Month_____________Day_____Year_________

(17)Activity providing income

(18) $ Amount you expect to receive from

(19)If student; what type?

(20)Spouse in USA?

(example: Teaching Assistant)?

VSU this year?

Undergraduate

Doctoral

Yes

No

_________________________

$_______________________

Masters

Other__________

# of

Dependents_________

(21)For Consultants/Self Employed Individuals (Faculty/Staff only):

(22)Country of Tax Residence (Faculty/Staff only)

Do you, or will you, have any office (fixed base) in the USA?

(see page 2 for definition)

Yes

No

If yes, how many days in THIS tax year did you,

________________________________________________

or will you, have office (fixed base)?__________________

Did tax residency end?

Yes

No

Days

If yes, when? Month___________Day_____Year______

IMPORTANT: If you wish to claim exemption from U.S. income tax because your country of legal permanent residence has a tax treaty with

the United States, each tax year you must complete IRS Form 8233 (Exemption from withholding for Compensation on Independent

Personal Services of a Non-Resident Alien Individual). Scholarship recipients must complete Form W-8BEN.

If your country has a tax treaty with the U.S. but you elect not to use these benefits, please initial here. ___________________________

I hereby certify that all of the above information is true and correct. I understand that if my status changes from that which I have indicated on this form, I

must submit a new VSU Tax Information Form for Internationals to the Financial Services office.

(23)_____________________________________

_________________________

________________________________

Signature

Date

Local Telephone Number

1

1 2

2