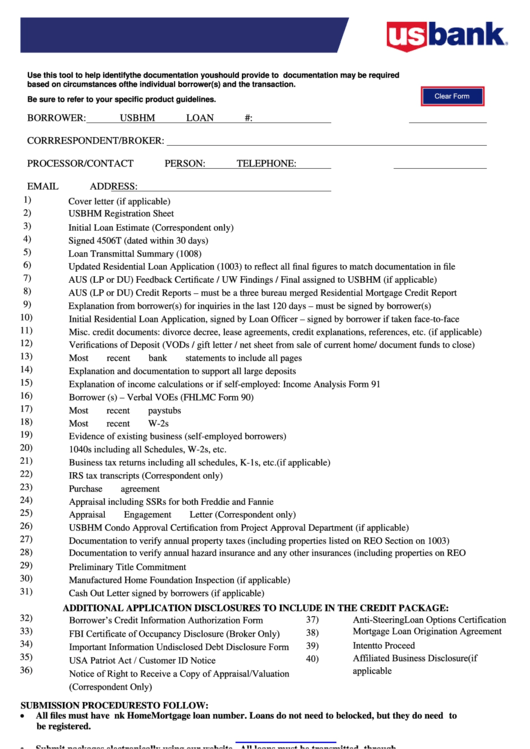

Use this tool to help identify the documentation you should provide to USBHM. Additional documentation may be required

based on circumstances of the individual borrower(s) and the transaction.

Clear Form

Be sure to refer to your specific product guidelines.

BORROWER:

USBHM LOAN #:

CORRRESPONDENT/BROKER:

PROCESSOR/CONTACT PERSON:

TELEPHONE:

EMAIL ADDRESS:

1)

Cover letter (if applicable)

2)

USBHM Registration Sheet

3)

Initial Loan Estimate (Correspondent only)

4)

Signed 4506T (dated within 30 days)

5)

Loan Transmittal Summary (1008)

6)

Updated Residential Loan Application (1003) to reflect all final figures to match documentation in file

7)

AUS (LP or DU) Feedback Certificate / UW Findings / Final assigned to USBHM (if applicable)

8)

AUS (LP or DU) Credit Reports – must be a three bureau merged Residential Mortgage Credit Report

9)

Explanation from borrower(s) for inquiries in the last 120 days – must be signed by borrower(s)

10)

Initial Residential Loan Application, signed by Loan Officer – signed by borrower if taken face-to-face

11)

Misc. credit documents: divorce decree, lease agreements, credit explanations, references, etc. (if applicable)

12)

Verifications of Deposit (VODs / gift letter / net sheet from sale of current home/ document funds to close)

13)

Most recent bank statements to include all pages

14)

Explanation and documentation to support all large deposits

15)

Explanation of income calculations or if self-employed: Income Analysis Form 91

16)

Borrower (s) – Verbal VOEs (FHLMC Form 90)

17)

Most recent paystubs

18)

Most recent W-2s

19)

Evidence of existing business (self-employed borrowers)

20)

1040s including all Schedules, W-2s, etc.

21)

Business tax returns including all schedules, K-1s, etc.(if applicable)

22)

IRS tax transcripts (Correspondent only)

23)

Purchase agreement

24)

Appraisal including SSRs for both Freddie and Fannie

25)

Appraisal Engagement Letter (Correspondent only)

26)

USBHM Condo Approval Certification from Project Approval Department (if applicable)

27)

Documentation to verify annual property taxes (including properties listed on REO Section on 1003)

28)

Documentation to verify annual hazard insurance and any other insurances (including properties on REO

29)

Preliminary Title Commitment

30)

Manufactured Home Foundation Inspection (if applicable)

31)

Cash Out Letter signed by borrowers (if applicable)

ADDITIONAL APPLICATION DISCLOSURES TO INCLUDE IN THE CREDIT PACKAGE:

Anti-Steering Loan Options Certification

37)

Borrower’s Credit Information Authorization Form

32)

Mortgage Loan Origination Agreement

FBI Certificate of Occupancy Disclosure (Broker Only)

33)

38)

Intent to Proceed

Important Information Undisclosed Debt Disclosure Form

34)

39)

Affiliated Business Disclosure (if

40)

35)

USA Patriot Act / Customer ID Notice

applicable

36)

Notice of Right to Receive a Copy of Appraisal/Valuation

(Correspondent Only)

SUBMISSION PROCEDURES TO FOLLOW:

•

All files must have a U.S. Bank Home Mortgage loan number. Loans do not need to be locked, but they do need to

be registered.

•

Submit packages electronically using our website . All loans must be transmitted through

LP (or DU if allowed by product guidelines), and final assigned to U.S. Bank.

•

For a HELOC, submit HELOC request form, 1008, 1003, Simultaneous HELOC disclosure, and HELOC MLOA.

•

For fixed rate second combo, submit complete copy package in separate upload with a separate loan number.

•

For pre submission underwriting guideline questions, call the UW help line at 866.807.6049 or check the product

matrix.

•

Registration/Lock info must match the 1003 Underwriting Transmittal and meet applicable product guidelines.

Thank you for choosing U.S. Bank Home Mortgage!

1

1