1

1

2

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

2

8

8

8

Clear Form

1

2

3

5

6 7 8 9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

4

82

3

3

Revenue Use Only

4

4

Date received

5

5

6

6

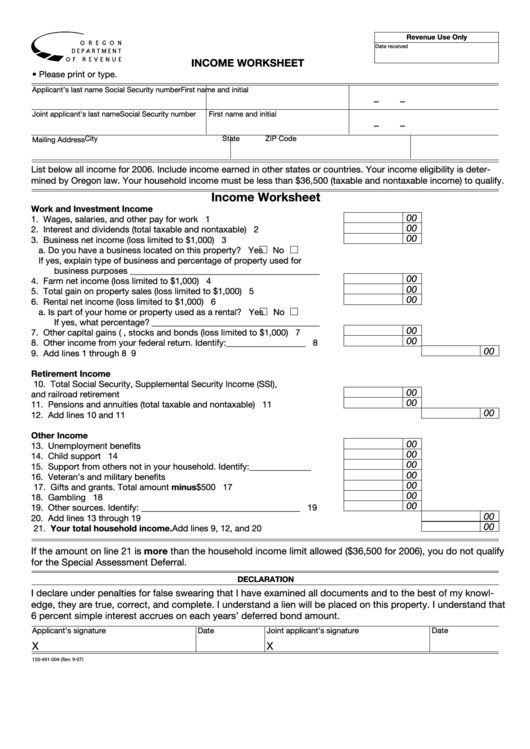

INCOME WORKSHEET

7

7

• Please print or type.

8

8

Applicant’s last name

First name and initial

Social Security number

9

9

–

–

10

10

11

11

Joint applicant’s last name

First name and initial

Social Security number

12

12

–

–

13

13

City

State

ZIP Code

Mailing Address

14

14

15

15

16

16

List below all income for 2006. Include income earned in other states or countries. Your income eligibility is deter-

17

17

mined by Oregon law. Your household income must be less than $36,500 (taxable and nontaxable income) to qualify.

18

18

Income Worksheet

19

19

20

20

Work and Investment Income

21

00

21

1. Wages, salaries, and other pay for work .................................................. 1

22

22

00

2. Interest and dividends (total taxable and nontaxable) ............................. 2

23

00

23

3. Business net income (loss limited to $1,000) ........................................... 3

24

24

a. Do you have a business located on this property?

Yes

No

25

25

If yes, explain type of business and percentage of property used for

26

26

business purposes ___________________________________________

00

27

27

4. Farm net income (loss limited to $1,000) ................................................. 4

00

28

28

5. Total gain on property sales (loss limited to $1,000) ................................ 5

00

29

29

6. Rental net income (loss limited to $1,000) ............................................... 6

30

30

a. Is part of your home or property used as a rental?

Yes

No

31

31

If yes, what percentage? ______________________________________

00

32

32

7. Other capital gains (i.e., stocks and bonds (loss limited to $1,000) ........ 7

00

33

33

8. Other income from your federal return. Identify:__________________ ..... 8

00

34

34

9. Add lines 1 through 8 .................................................................................................................. 9

35

35

36

36

Retirement Income

37

37

10. Total Social Security, Supplemental Security Income (SSI),

00

38

38

and railroad retirement ............................................................................. 10

00

39

39

11. Pensions and annuities (total taxable and nontaxable) ............................ 11

00

40

40

12. Add lines 10 and 11 .................................................................................................................. 12

41

41

42

42

Other Income

00

43

43

13. Unemployment benefits ........................................................................... 13

00

44

44

14. Child support ........................................................................................... 14

00

45

45

15. Support from others not in your household. Identify:______________ ..... 15

00

46

46

16. Veteran’s and military benefits ................................................................. 16

00

47

47

17. Gifts and grants. Total amount minus $500 ............................................ 17

00

48

18. Gambling winnings................................................................................... 18

48

00

49

49

19. Other sources. Identify: ____________________________________ .......... 19

00

50

20. Add lines 13 through 19 ............................................................................................................ 20

50

00

51

51

21. Your total household income. Add lines 9, 12, and 20 .......................................................... 21

52

52

53

53

If the amount on line 21 is more than the household income limit allowed ($36,500 for 2006), you do not qualify

54

54

for the Special Assessment Deferral.

55

55

DECLARATION

56

56

57

57

I declare under penalties for false swearing that I have examined all documents and to the best of my knowl-

58

58

edge, they are true, correct, and complete. I understand a lien will be placed on this property. I understand that

59

59

6 percent simple interest accrues on each years’ deferred bond amount.

60

60

Applicant’s signature

Date

Joint applicant’s signature

Date

61

61

62

62

X

X

63

63

64

64

65

65

8

8

8

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

1

2

3

5

6 7 8 9

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

0

4

82

66

66

1

1