Tab to navigate

Save

Print

Clear

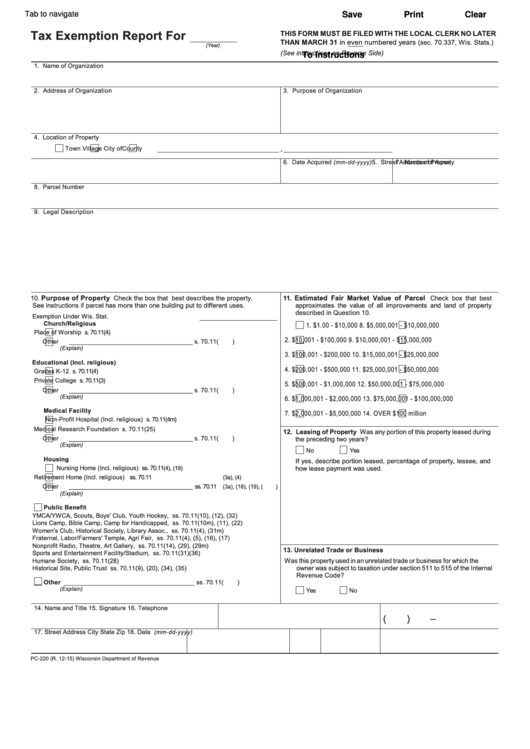

Tax Exemption Report For

THIS FORM MUST BE FILED WITH THE LOCAL CLERK NO LATER

THAN MARCH 31 in even numbered years (sec. 70.337, Wis. Stats.)

(Year)

(See instructions on Reverse Side)

To instructions

1. Name of Organization

2. Address of Organization

3. Purpose of Organization

4. Location of Property

Town

Village

City of

,

County

5. Street Address of Property

6. Date Acquired

(mm‑dd‑yyyy)

7. Number of Acres

8. Parcel Number

9. Legal Description

Purpose of Property Check the box that best describes the property.

Estimated Fair Market Value of Parcel Check box that best

10.

11.

See instructions if parcel has more than one building put to different uses.

approximates the value of all improvements and land of property

described in Question 10.

Exemption Under Wis. Stat.

Church/Religious

1. $1.00 - $10,000

8. $5,000,001 - $10,000,000

Place of Worship . . . . . . . . . . . . . . . . . . . . . . . . . . s. 70.11(4)

2. $10,001 - $100,000

9. $10,000,001 - $15,000,000

Other ____________________________________ s. 70.11(

)

(Explain)

3. $100,001 - $200,000

10. $15,000,001 - $25,000,000

Educational (Incl. religious)

4. $200,001 - $500,000

11. $25,000,001 - $50,000,000

Grades K-12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . s. 70.11(4)

Private College . . . . . . . . . . . . . . . . . . . . . . . . . . . . s. 70.11(3)

5. $500,001 - $1,000,000

12. $50,000,001 - $75,000,000

Other ____________________________________ s. 70.11(

)

(Explain)

6. $1,000,001 - $2,000,000

13. $75,000,001 - $100,000,000

Medical Facility

7. $2,000,001 - $5,000,000

14. OVER $100 million

Non-Profit Hospital (Incl. religious) . . . . . . . . . . . . s. 70.11(4m)

Medical Research Foundation . . . . . . . . . . . . . . . . s. 70.11(25)

12. Leasing of Property Was any portion of this property leased during

Other ____________________________________ s. 70.11(

)

the preceding two years?

(Explain)

No

Yes

Housing

If yes, describe portion leased, percentage of property, lessee, and

Nursing Home (Incl. religious) . . . . . . . . . . . . . . . . ss. 70.11

(4), (19)

how lease payment was used.

Retirement Home (Incl. religious) . . . . . . . . . . . . . ss. 70.11

(3a), (4)

Other ____________________________________ ss. 70.11

(3a), (18), (19), (

)

(Explain)

Public Benefit

YMCA/YWCA, Scouts, Boys' Club, Youth Hockey,

ss. 70.11(10), (12), (32)

Lions Camp, Bible Camp, Camp for Handicapped,

ss. 70.11(10m), (11), (22)

Women's Club, Historical Society, Library Assoc.,

ss. 70.11(4), (31m)

Fraternal, Labor/Farmers' Temple, Agri Fair,

ss. 70.11(4), (5), (16), (17)

Nonprofit Radio, Theatre, Art Gallery,

ss. 70.11(14), (29), (29m)

13. Unrelated Trade or Business

Sports and Entertainment Facility/Stadium,

ss. 70.11(31)(36)

Was this property used in an unrelated trade or business for which the

Humane Society,

ss. 70.11(28)

owner was subject to taxation under section 511 to 515 of the Internal

Historical Site, Public Trust

ss. 70.11(9), (20), (34), (35)

Revenue Code?

Other ______________________________________ ss. 70.11(

)

(Explain)

Yes

No

14. Name and Title

15. Signature

16. Telephone

(

)

–

17. Street Address

City

State

Zip

18. Date

(mm‑dd‑yyyy)

PC-220 (R. 12-15)

Wisconsin Department of Revenue

1

1 2

2