Form F-1159 - Application For Child Care Tax Credits - 2003

ADVERTISEMENT

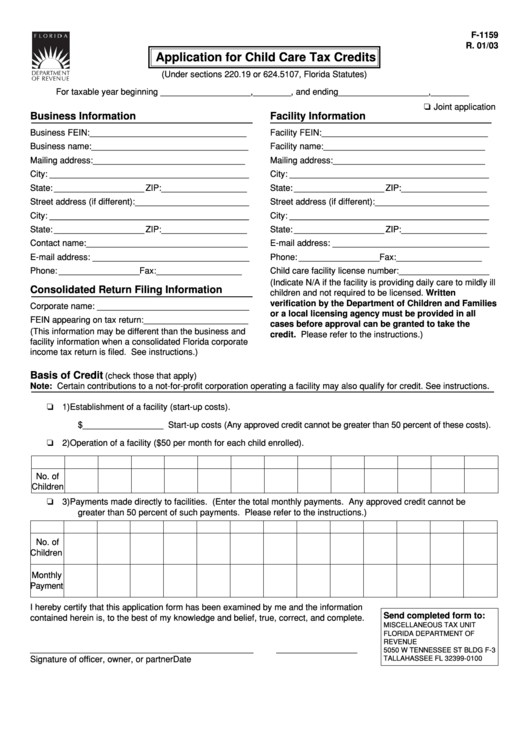

F-1159

R. 01/03

Application for Child Care Tax Credits

(Under sections 220.19 or 624.5107, Florida Statutes)

For taxable year beginning ___________________,________, and ending___________________,________

❏ Joint application

Business Information

Facility Information

Business FEIN: _________________________________

Facility FEIN: ___________________________________

Business name: _________________________________

Facility name: __________________________________

Mailing address: ________________________________

Mailing address: ________________________________

City: __________________________________________

City: __________________________________________

State: ___________________ ZIP: __________________

State: ___________________ ZIP: __________________

Street address (if different): ________________________

Street address (if different): ________________________

City: __________________________________________

City: __________________________________________

State: ___________________ ZIP: __________________

State: ___________________ ZIP: __________________

Contact name: __________________________________

E-mail address: _________________________________

E-mail address: _________________________________

Phone: _________________ Fax: __________________

Phone: _________________ Fax: __________________

Child care facility license number: ___________________

(Indicate N/A if the facility is providing daily care to mildly ill

Consolidated Return Filing Information

children and not required to be licensed. Written

verification by the Department of Children and Families

Corporate name: ________________________________

or a local licensing agency must be provided in all

FEIN appearing on tax return: ______________________

cases before approval can be granted to take the

(This information may be different than the business and

credit. Please refer to the instructions.)

facility information when a consolidated Florida corporate

income tax return is filed. See instructions.)

Basis of Credit

(check those that apply)

Note: Certain contributions to a not-for-profit corporation operating a facility may also qualify for credit. See instructions.

❏ 1) Establishment of a facility (start-up costs).

$_________________ Start-up costs (Any approved credit cannot be greater than 50 percent of these costs).

❏ 2) Operation of a facility ($50 per month for each child enrolled).

Jan.

Feb.

March

April

May

June

July

Aug.

Sept.

Oct.

Nov.

Dec.

Total

No. of

Children

❏ 3) Payments made directly to facilities. (Enter the total monthly payments. Any approved credit cannot be

greater than 50 percent of such payments. Please refer to the instructions.)

Jan.

Feb.

March

April

May

June

July

Aug.

Sept.

Oct.

Nov.

Dec.

Total

No. of

Children

Monthly

Payment

I hereby certify that this application form has been examined by me and the information

Send completed form to:

contained herein is, to the best of my knowledge and belief, true, correct, and complete.

MISCELLANEOUS TAX UNIT

FLORIDA DEPARTMENT OF

REVENUE

_______________________________________________

_________________

5050 W TENNESSEE ST BLDG F-3

TALLAHASSEE FL 32399-0100

Signature of officer, owner, or partner

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1