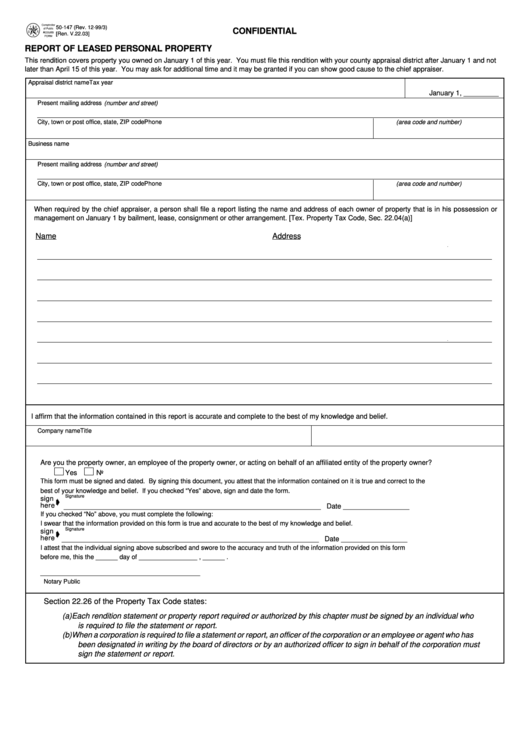

50-147 (Rev. 12-99/3)

CONFIDENTIAL

[Ren. V.22.03]

REPORT OF LEASED PERSONAL PROPERTY

This rendition covers property you owned on January 1 of this year. You must file this rendition with your county appraisal district after January 1 and not

later than April 15 of this year. You may ask for additional time and it may be granted if you can show good cause to the chief appraiser.

Appraisal district name

Tax year

January 1, _________

Present mailing address (number and street)

City, town or post office, state, ZIP code

Phone (area code and number)

Business name

Present mailing address (number and street)

City, town or post office, state, ZIP code

Phone (area code and number)

When required by the chief appraiser, a person shall file a report listing the name and address of each owner of property that is in his possession or

management on January 1 by bailment, lease, consignment or other arrangement. [Tex. Property Tax Code, Sec. 22.04(a)]

Name

Address

I affirm that the information contained in this report is accurate and complete to the best of my knowledge and belief.

Company name

Title

Are you the property owner, an employee of the property owner, or acting on behalf of an affiliated entity of the property owner?

Yes

No

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the

best of your knowledge and belief. If you checked “Yes” above, sign and date the form.

Signature

sign

here

__________________________________________________________________ Date _________________

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and accurate to the best of my knowledge and belief.

Signature

sign

here

__________________________________________________________________ Date _________________

I attest that the individual signing above subscribed and swore to the accuracy and truth of the information provided on this form

before me, this the ______ day of ________________ , ______ .

_________________________________________

Notary Public

Section 22.26 of the Property Tax Code states:

(a) Each rendition statement or property report required or authorized by this chapter must be signed by an individual who

is required to file the statement or report.

(b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has

been designated in writing by the board of directors or by an authorized officer to sign in behalf of the corporation must

sign the statement or report.

1

1