Form Nd-1(B) - Detailed Instructions For This Form Are On The Reverse Side Of The Emst-5 Form

ADVERTISEMENT

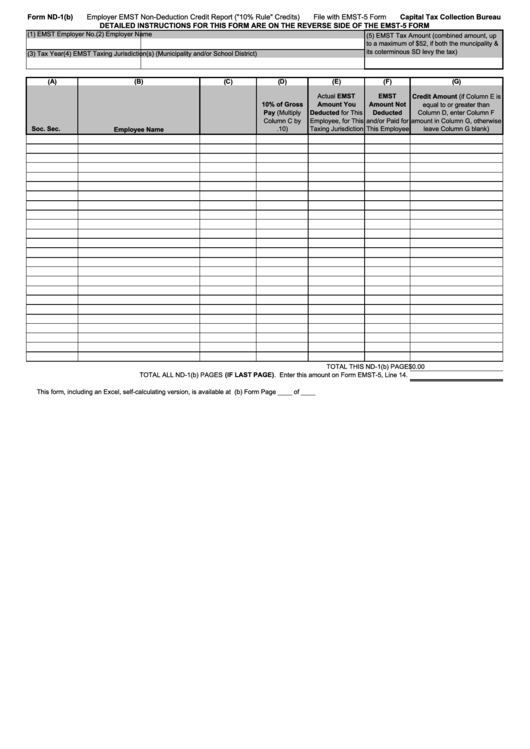

Form ND-1(b)

Employer EMST Non-Deduction Credit Report ("10% Rule" Credits)

File with EMST-5 Form

Capital Tax Collection Bureau

DETAILED INSTRUCTIONS FOR THIS FORM ARE ON THE REVERSE SIDE OF THE EMST-5 FORM

(1) EMST Employer No.

(2) Employer Name

(5) EMST Tax Amount (combined amount, up

to a maximum of $52, if both the muncipality &

its coterminous SD levy the tax)

(3) Tax Year

(4) EMST Taxing Jurisdiction(s) (Municipality and/or School District)

(A)

(B)

(C)

(D)

(E)

(F)

(G)

Actual EMST

EMST

Credit Amount (if Column E is

10% of Gross

Amount You

Amount Not

equal to or greater than

Pay (Multiply

Deducted for This

Deducted

Column D, enter Column F

Column C by

Employee, for This

and/or Paid for

amount in Column G, otherwise

Soc. Sec. No.

Gross Pay

.10)

Taxing Jurisdiction

This Employee

leave Column G blank)

Employee Name

TOTAL THIS ND-1(b) PAGE

$0.00

TOTAL ALL ND-1(b) PAGES (IF LAST PAGE). Enter this amount on Form EMST-5, Line 14.

This form, including an Excel, self-calculating version, is available at

ND-1(b) Form Page ____ of ____

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1