Power Of Attorney For Department Administered Sales And Use Tax Matters

ADVERTISEMENT

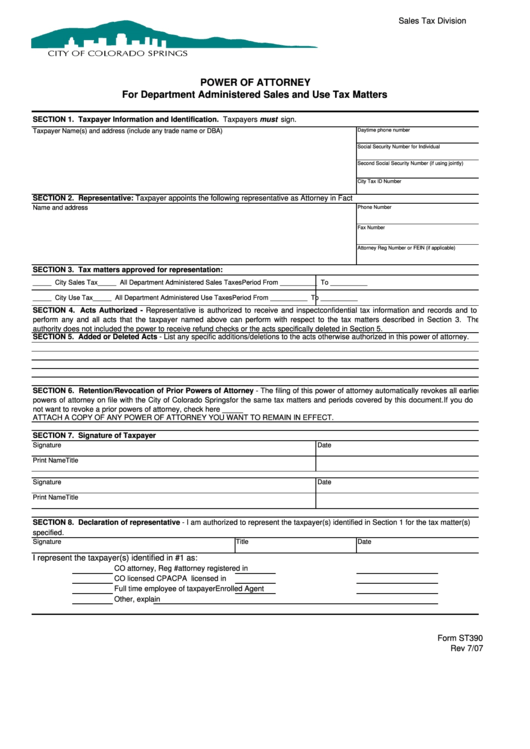

Sales Tax Division

POWER OF ATTORNEY

For Department Administered Sales and Use Tax Matters

SECTION 1. Taxpayer Information and Identification. Taxpayers must sign.

Taxpayer Name(s) and address (include any trade name or DBA)

Daytime phone number

Social Security Number for Individual

Second Social Security Number (if using jointly)

City Tax ID Number

SECTION 2. Representative: Taxpayer appoints the following representative as Attorney in Fact

Name and address

Phone Number

Fax Number

Attorney Reg Number or FEIN (if applicable)

SECTION 3. Tax matters approved for representation:

_____ City Sales Tax

_____ All Department Administered Sales Taxes

Period From __________ To __________

_____ City Use Tax

_____ All Department Administered Use Taxes

Period From __________ To __________

SECTION 4. Acts Authorized - Representative is authorized to receive and inspect confidential tax information and records and to

perform any and all acts that the taxpayer named above can perform with respect to the tax matters described in Section 3. The

authority does not included the power to receive refund checks or the acts specifically deleted in Section 5.

SECTION 5. Added or Deleted Acts - List any specific additions/deletions to the acts otherwise authorized in this power of attorney.

SECTION 6. Retention/Revocation of Prior Powers of Attorney - The filing of this power of attorney automatically revokes all earlier

powers of attorney on file with the City of Colorado Springs for the same tax matters and periods covered by this document. If you do

not want to revoke a prior powers of attorney, check here _____

ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

SECTION 7. Signature of Taxpayer

Signature

Date

Print Name

Title

Signature

Date

Print Name

Title

SECTION 8. Declaration of representative - I am authorized to represent the taxpayer(s) identified in Section 1 for the tax matter(s)

specified.

Signature

Title

Date

I represent the taxpayer(s) identified in #1 as:

CO attorney, Reg #

attorney registered in

CO licensed CPA

CPA licensed in

Full time employee of taxpayer

Enrolled Agent

Other, explain

Form ST390

Rev 7/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1