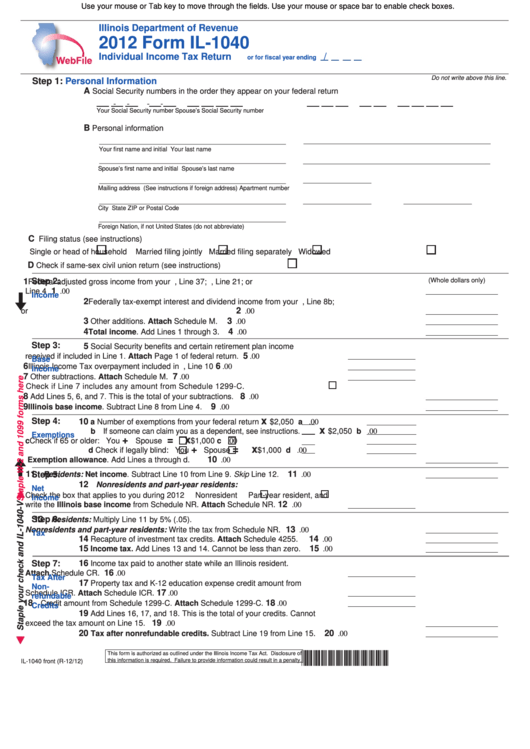

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2012 Form IL-1040

Individual Income Tax Return

/

or for fiscal year ending

tax.illinois.gov

Do not write above this line.

Step 1:

Personal Information

A

Social Security numbers in the order they appear on your federal return

-

-

-

-

Your Social Security number

Spouse’s Social Security number

B

Personal information

Your first name and initial

Your last name

Spouse’s first name and initial

Spouse’s last name

Mailing address (See instructions if foreign address)

Apartment number

City

State

ZIP or Postal Code

Foreign Nation, if not United States (do not abbreviate)

C

Filing status (see instructions)

Single or head of household

Married filing jointly

Married filing separately

Widowed

D

Check if same-sex civil union return (see instructions)

(Whole dollars only)

Step 2:

1

Federal adjusted gross income from your U.S. 1040, Line 37; U.S. 1040A, Line 21; or

1

U.S. 1040EZ, Line 4

.00

Income

2

Federally tax-exempt interest and dividend income from your U.S. 1040 or 1040A, Line 8b;

2

or U.S. 1040EZ

.00

3

3

Other additions. Attach Schedule M.

.00

4

4

Total income. Add Lines 1 through 3.

.00

Step 3:

5

Social Security benefits and certain retirement plan income

5

received if included in Line 1. Attach Page 1 of federal return.

.00

Base

6

6

Illinois Income Tax overpayment included in U.S. 1040, Line 10

.00

Income

7

7

Other subtractions. Attach Schedule M.

.00

Check if Line 7 includes any amount from Schedule 1299-C.

8

8

Add Lines 5, 6, and 7. This is the total of your subtractions.

.00

9

9

Illinois base income. Subtract Line 8 from Line 4.

.00

x

Step 4:

10

a Number of exemptions from your federal return

$2,050 a

.00

x

b If someone can claim you as a dependent, see instructions.

$2,050 b

.00

Exemptions

+

=

x

c Check if 65 or older:

You

Spouse

$1,000 c

.00

+

=

x

d Check if legally blind:

You

Spouse

$1,000 d

.00

10

Exemption allowance. Add Lines a through d.

.00

11

11

Step 5:

Residents: Net income. Subtract Line 10 from Line 9. Skip Line 12.

.00

12

Nonresidents and part-year residents:

Net

Check the box that applies to you during 2012

Nonresident

Part-year resident, and

Income

12

write the Illinois base income from Schedule NR. Attach Schedule NR.

.00

Step 6:

13

Residents: Multiply Line 11 by 5% (.05).

13

Nonresidents and part-year residents: Write the tax from Schedule NR.

.00

Tax

14

14

Recapture of investment tax credits. Attach Schedule 4255.

.00

15

15

Income tax. Add Lines 13 and 14. Cannot be less than zero.

.00

Step 7:

16

Income tax paid to another state while an Illinois resident.

16

Attach Schedule CR.

.00

Tax After

17

Property tax and K-12 education expense credit amount from

Non-

17

Schedule ICR. Attach Schedule ICR.

.00

refundable

18

18

Credit amount from Schedule 1299-C. Attach Schedule 1299-C.

.00

Credits

19

Add Lines 16, 17, and 18. This is the total of your credits. Cannot

19

exceed the tax amount on Line 15.

.00

20

20

Tax after nonrefundable credits. Subtract Line 19 from Line 15.

.00

*260001110*

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

this information is required. Failure to provide information could result in a penalty.

IL-1040 front (R-12/12)

1

1 2

2