Travel Expense Report/employee Reimbursement Spreadsheet

ADVERTISEMENT

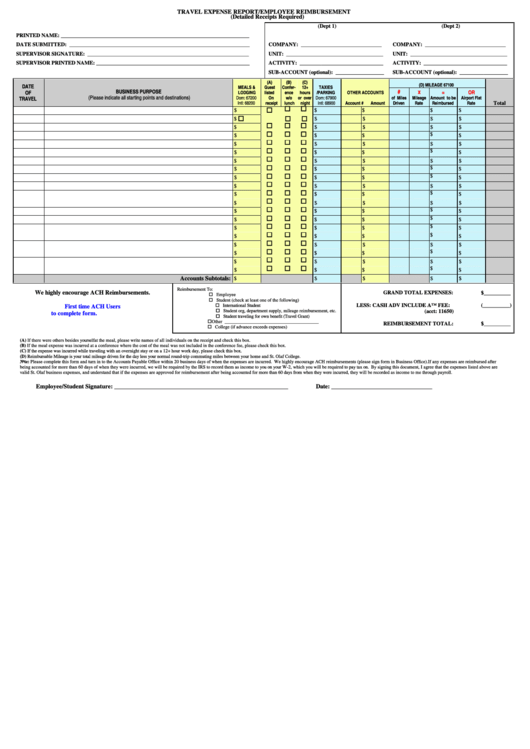

TRAVEL EXPENSE REPORT/EMPLOYEE REIMBURSEMENT

(Detailed Receipts Required)

(Dept 1)

(Dept 2)

PRINTED NAME: ______________________________________________________________________

DATE SUBMITTED: ___________________________________________________________________

COMPANY: ______________________________

COMPANY: ______________________________

SUPERVISOR SIGNATURE: ____________________________________________________________

UNIT: ____________________________________

UNIT: ____________________________________

SUPERVISOR PRINTED NAME: _________________________________________________________

ACTIVITY: _______________________________

ACTIVITY: _______________________________

SUB-ACCOUNT (optional): __________________

SUB-ACCOUNT (optional): __________________

(A)

(B)

(C)

(D) MILEAGE 67100

DATE

MEALS &

Guest

Confer-

12+

TAXIES

BUSINESS PURPOSE

#

x

=

OR

OF

LODGING

listed

ence

hours

/PARKING

OTHER ACCOUNTS

(Please indicate all starting points and destinations)

TRAVEL

Dom: 67200

On

w/o

or over

Dom: 67900

of Miles

Mileage

Amount to be

Airport Flat

Intl: 68200

receipt

lunch

night

Intl: 68900

Account #

Amount

Driven

Rate

Reimbursed

Rate

Total

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Accounts Subtotals:

$

$

$

$

$

Reimbursement To:

We highly encourage ACH Reimbursements.

GRAND TOTAL EXPENSES:

$__________

Employee

Student (check at least one of the following)

International Student

LESS: CASH ADV INCLUDE ATM FEE:

(__________)

First time ACH Users

Student org, department supply, mileage reimbursement, etc.

(acct: 11650)

CLICK HERE to complete form.

Student traveling for own benefit (Travel Grant)

Other ________________________________________

REIMBURSEMENT TOTAL:

$__________

College (if advance exceeds expenses)

(A) If there were others besides yourself at the meal, please write names of all individuals on the receipt and check this box.

(B) If the meal expense was incurred at a conference where the cost of the meal was not included in the conference fee, please check this box.

(C) If the expense was incurred while traveling with an overnight stay or on a 12+ hour work day, please check this box.

(D) Reimbursable Mileage is your total mileage driven for the day less your normal round-trip commuting miles between your home and St. Olaf College.

Note: Please complete this form and turn in to the Accounts Payable Office within 20 business days of when the expenses are incurred. We highly encourage ACH reimbursements (please sign form in Business Office). If any expenses are reimbursed after

being accounted for more than 60 days of when they were incurred, we will be required by the IRS to record them as income to you on your W-2, which you will be required to pay tax on. By signing this document, I agree that the expenses listed above are

valid St. Olaf business expenses, and understand that if the expenses are approved for reimbursement after being accounted for more than 60 days from when they were incurred, they will be recorded as income to me through payroll.

Employee/Student Signature: _________________________________________________________

Date: __________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1