Refund Request Form

Download a blank fillable Refund Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Refund Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Print

Reset Form

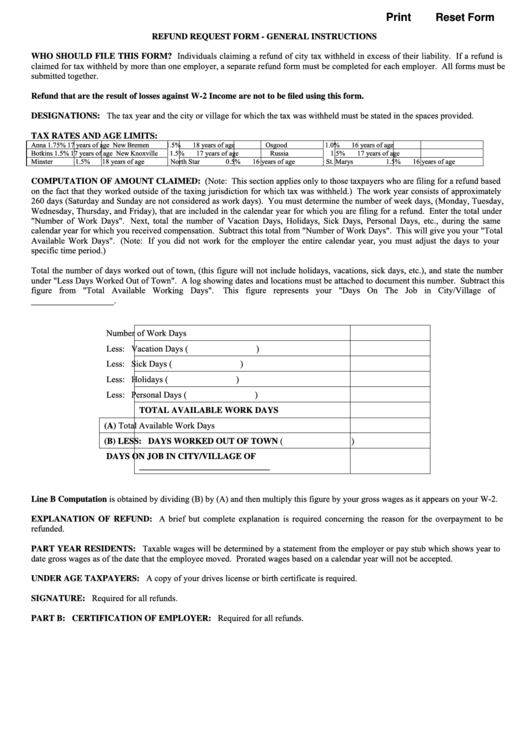

REFUND REQUEST FORM - GENERAL INSTRUCTIONS

WHO SHOULD FILE THIS FORM? Individuals claiming a refund of city tax withheld in excess of their liability. If a refund is

claimed for tax withheld by more than one employer, a separate refund form must be completed for each employer. All forms must be

submitted together.

Refund that are the result of losses against W-2 Income are not to be filed using this form.

DESIGNATIONS: The tax year and the city or village for which the tax was withheld must be stated in the spaces provided.

TAX RATES AND AGE LIMITS:

Anna

1.75%

17 years of age

New Bremen

1.5%

18 years of age

Osgood

1.0%

16 years of age

Botkins

1.5%

17 years of age

New Knoxville

1.5%

17 years of age

Russia

1.5%

17 years of age

Minster

1.5%

18 years of age

North Star

0.5%

16 years of age

St. Marys

1.5%

16 years of age

COMPUTATION OF AMOUNT CLAIMED: (Note: This section applies only to those taxpayers who are filing for a refund based

on the fact that they worked outside of the taxing jurisdiction for which tax was withheld.) The work year consists of approximately

260 days (Saturday and Sunday are not considered as work days). You must determine the number of week days, (Monday, Tuesday,

Wednesday, Thursday, and Friday), that are included in the calendar year for which you are filing for a refund. Enter the total under

"Number of Work Days". Next, total the nu mber of Vacation Days, Holidays, Sick Days, Personal Days, etc., during the same

calendar year for which you received compensation. Subtract this total from "Number of Work Days". This will give you your "Total

Available Work Days". (Note: If you did not work for the employer the entire calendar year, you must adjust the d ays to you r

specific time period.)

Total the number of days worked out of town, (this figure will not include holidays, vacations, sick days, etc.), and state the number

under "Less Days Worked Out of Town". A log showing dates and locations must be attached to document this number. Subtract this

figure from "Total Available Working Days".

Th is figure represents your "D ays On The Job in City/V illage of

___________________.

Number of Work Days

Less: Vacation Days

(

)

Less: Sick Days

(

)

Less: Holidays

(

)

Less: Personal Days

(

)

TOTAL AVAILABLE WORK DAYS

Total Available Work Days

(A)

(

)

(B)

LESS: DAYS WORKED OUT OF TOWN

DAYS ON JOB IN CITY/VILLAGE OF

______________________________

Line B Computation is obtained by dividing (B) by (A) and then multiply this figure by your gross wages as it appears on your W-2.

EXPLANATION OF REFUND: A brief but complete explanation is required concerning the reason for the overpayment to be

refunded.

PART YEAR RESIDENTS: Taxable wages will be determined by a statement from the employer or pay stub which shows year to

date gross wages as of the date that the employee moved. Prorated wages based on a calendar year will not be accepted.

UNDER AGE TAXPAYERS: A copy of your drives license or birth certificate is required.

SIGNATURE: Required for all refunds.

PART B: CERTIFICATION OF EMPLOYER: Required for all refunds.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2