Special Circumstances Appeal Form

ADVERTISEMENT

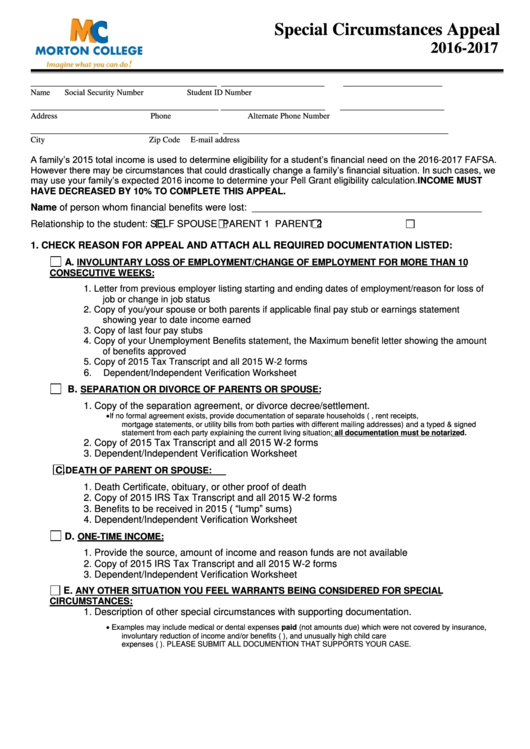

Special Circumstances Appeal

2016-2017

_____________________________________________

_________________________

________________________

Name

Social Security Number

Student ID Number

_____________________________________________

_________________________

_________________________

Address

Phone

Alternate Phone Number

_____________________________________________

______________________________________________________

City

Zip Code

E-mail address

A family’s 2015 total income is used to determine eligibility for a student’s financial need on the 2016-2017 FAFSA.

However there may be circumstances that could drastically change a family’s financial situation. In such cases, we

may use your family’s expected 2016 income to determine your Pell Grant eligibility calculation. INCOME MUST

HAVE DECREASED BY 10% TO COMPLETE THIS APPEAL.

Name of person whom financial benefits were lost: ___________________________________________

Relationship to the student:

SELF

SPOUSE

PARENT 1

PARENT 2

1. CHECK REASON FOR APPEAL AND ATTACH ALL REQUIRED DOCUMENTATION LISTED:

A. INVOLUNTARY LOSS OF EMPLOYMENT/CHANGE OF EMPLOYMENT FOR MORE THAN 10

CONSECUTIVE WEEKS:

1.

Letter from previous employer listing starting and ending dates of employment/reason for loss of

job or change in job status

2.

Copy of you/your spouse or both parents if applicable final pay stub or earnings statement

showing year to date income earned

3.

Copy of last four pay stubs

4.

Copy of your Unemployment Benefits statement, the Maximum benefit letter showing the amount

of benefits approved

5.

Copy of 2015 Tax Transcript and all 2015 W-2 forms

6.

Dependent/Independent Verification Worksheet

.

B

SEPARATION OR DIVORCE OF PARENTS OR SPOUSE:

1.

Copy of the separation agreement, or divorce decree/settlement.

If no formal agreement exists, provide documentation of separate households (e.g. separate leases, rent receipts,

mortgage statements, or utility bills from both parties with different mailing addresses) and a typed & signed

statement from each party explaining the current living situation; all documentation must be notarized.

2.

Copy of 2015 Tax Transcript and all 2015 W-2 forms

3.

Dependent/Independent Verification Worksheet

.

C

DEATH OF PARENT OR SPOUSE:

1.

Death Certificate, obituary, or other proof of death

2.

Copy of 2015 IRS Tax Transcript and all 2015 W-2 forms

Benefits to be received in 2015 (e.g. insurance benefits and/or “lump” sums)

3.

4.

Dependent/Independent Verification Worksheet

.

D

ONE-TIME INCOME:

1.

Provide the source, amount of income and reason funds are not available

2.

Copy of 2015 IRS Tax Transcript and all 2015 W-2 forms

3.

Dependent/Independent Verification Worksheet

E. ANY OTHER SITUATION YOU FEEL WARRANTS BEING CONSIDERED FOR SPECIAL

CIRCUMSTANCES:

1.

Description of other special circumstances with supporting documentation.

Examples may include medical or dental expenses paid (not amounts due) which were not covered by insurance,

involuntary reduction of income and/or benefits (e.g. work hours reduced by employer), and unusually high child care

expenses (e.g. special education needs). PLEASE SUBMIT ALL DOCUMENTION THAT SUPPORTS YOUR CASE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2