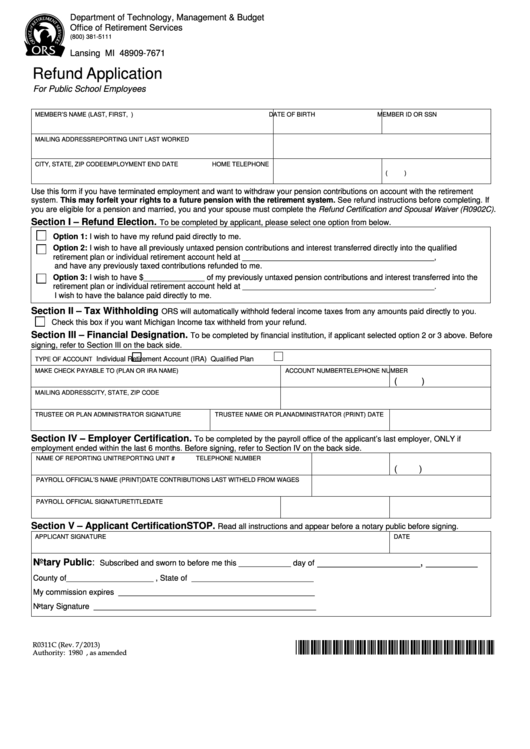

Refund Application For Public School Employees Form

ADVERTISEMENT

Department of Technology, Management & Budget

Office of Retirement Services

(800) 381-5111

P.O. Box 30171

Lansing MI 48909-7671

Refund Application

For Public School Employees

MEMBER’S NAME (LAST, FIRST, M.I.)

DATE OF BIRTH

MEMBER ID OR SSN

MAILING ADDRESS

REPORTING UNIT LAST WORKED

CITY, STATE, ZIP CODE

EMPLOYMENT END DATE

HOME TELEPHONE

(

)

Use this form if you have terminated employment and want to withdraw your pension contributions on account with the retirement

system. This may forfeit your rights to a future pension with the retirement system. See refund instructions before completing. If

you are eligible for a pension and married, you and your spouse must complete the Refund Certification and Spousal Waiver (R0902C).

Section I – Refund Election.

To be completed by applicant, please select one option from below.

Option 1: I wish to have my refund paid directly to me.

Option 2: I wish to have all previously untaxed pension contributions and interest transferred directly into the qualified

retirement plan or individual retirement account held at ____________________________________________,

and have any previously taxed contributions refunded to me.

Option 3: I wish to have $______________ of my previously untaxed pension contributions and interest transferred into the

retirement plan or individual retirement account held at ____________________________________________.

I wish to have the balance paid directly to me.

Section II – Tax Withholding

ORS will automatically withhold federal income taxes from any amounts paid directly to you.

Check this box if you want Michigan Income tax withheld from your refund.

Section III – Financial Designation.

To be completed by financial institution, if applicant selected option 2 or 3 above. Before

signing, refer to Section III on the back side.

Individual Retirement Account (IRA)

Qualified Plan

TYPE OF ACCOUNT

MAKE CHECK PAYABLE TO (PLAN OR IRA NAME)

ACCOUNT NUMBER

TELEPHONE NUMBER

(

)

MAILING ADDRESS

CITY, STATE, ZIP CODE

TRUSTEE OR PLAN ADMINISTRATOR SIGNATURE

TRUSTEE NAME OR PLAN ADMINISTRATOR (PRINT)

DATE

Section IV – Employer Certification.

To be completed by the payroll office of the applicant’s last employer, ONLY if

employment ended within the last 6 months. Before signing, refer to Section IV on the back side.

NAME OF REPORTING UNIT

REPORTING UNIT #

TELEPHONE NUMBER

(

)

PAYROLL OFFICIAL’S NAME (PRINT)

DATE CONTRIBUTIONS LAST WITHELD FROM WAGES

PAYROLL OFFICIAL SIGNATURE

TITLE

DATE

Section V – Applicant Certification STOP.

Read all instructions and appear before a notary public before signing.

APPLICANT SIGNATURE

DATE

__________________, _________

Notary Public:

Subscribed and sworn to before me this ____________ day of

County of ____________________ , State of ____________________________

My commission expires _____________________________________________

Notary Signature ___________________________________________________

R0311C (Rev. 7/2013)

*0000720000000009*

Authority: 1980 P.A. 300, as amended

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2