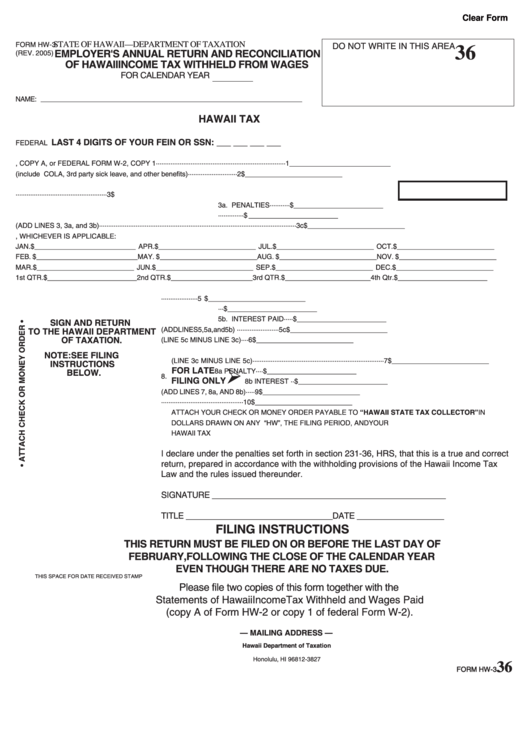

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM HW-3

DO NOT WRITE IN THIS AREA

36

EMPLOYER'S ANNUAL RETURN AND RECONCILIATION

(REV. 2005)

OF HAWAII INCOME TAX WITHHELD FROM WAGES

FOR CALENDAR YEAR

NAME:

HAWAII TAX I.D. NO. W __ __ __ __ __ __ __ __ - __ __

LAST 4 DIGITS OF YOUR FEIN OR SSN: ___ ___ ___ ___

FEDERAL I.D. NO. _________________________________

1. NUMBER OF HW-2 FORMS, COPY A, or FEDERAL FORM W-2, COPY 1 ·······································································1 __________________________

2. TOTAL WAGES SHOWN ON THESE FORMS (include COLA, 3rd party sick leave, and other benefits) ···························2 $ _________________________

3. TOTAL HAWAII INCOME TAX WITHHELD FROM WAGES SHOWN ON THESE FORMS··················································3 $

3a. PENALTIES ··········· $ _______________________

3b. INTEREST ·············· $ _______________________

3c. TOTAL AMOUNT DUE (ADD LINES 3, 3a, and 3b) ············································································································3c $ _________________________

4. PAYMENT OF TAXES WITHHELD BY MONTHS OR CALENDAR QUARTERS, WHICHEVER IS APPLICABLE:

JAN. $ __________________________ APR. $ _________________________ JUL. $ _________________________ OCT. $ _________________________

FEB. $ __________________________ MAY. $ _________________________ AUG. $ _________________________ NOV. $ _________________________

MAR. $ _________________________ JUN. $ _________________________ SEP. $ _________________________ DEC. $ _________________________

1st QTR. $_______________________ 2nd QTR. $ _____________________ 3rd QTR. $ ______________________ 4th Qtr. $ _______________________

5. TOTAL PAYMENTS OF TAXES WITHHELD FROM LINE 4····················5 $ _________________________

5a. PENALTIES PAID ··· $ _______________________

5b. INTEREST PAID ····· $ _______________________

SIGN AND RETURN

5c. TOTAL PAYMENTS MADE (ADD LINES 5, 5a, and 5b) ·······················5c $ _________________________

TO THE HAWAII DEPARTMENT

OF TAXATION.

6. AMOUNT OF CREDIT TO BE REFUNDED (LINE 5c MINUS LINE 3c)····6 $ _________________________

7. AMOUNT OF TAXES NOW DUE AND PAYABLE

NOTE: SEE FILING

(LINE 3c MINUS LINE 5c)········································································7 $ _________________________

INSTRUCTIONS

Ø

FOR LATE

8a PENALTY ···· $ _______________________

BELOW.

8.

FILING ONLY

8b INTEREST ·· $ _______________________

9. TOTAL AMOUNT NOW DUE AND PAYABLE (ADD LINES 7, 8a, AND 8b)·····9 $ _________________________

10. PLEASE ENTER AMOUNT OF PAYMENT ·············································10 $ _________________________

ATTACH YOUR CHECK OR MONEY ORDER PAYABLE TO “HAWAII STATE TAX COLLECTOR” IN U.S.

DOLLARS DRAWN ON ANY U.S. BANK TO FORM HW-3. WRITE “HW”, THE FILING PERIOD, AND YOUR

HAWAII TAX I.D. NO. ON YOUR CHECK OR MONEY ORDER.

I declare under the penalties set forth in section 231-36, HRS, that this is a true and correct

return, prepared in accordance with the withholding provisions of the Hawaii Income Tax

Law and the rules issued thereunder.

SIGNATURE ___________________________________________________

TITLE ________________________________ DATE ___________________

FILING INSTRUCTIONS

THIS RETURN MUST BE FILED ON OR BEFORE THE LAST DAY OF

FEBRUARY, FOLLOWING THE CLOSE OF THE CALENDAR YEAR

EVEN THOUGH THERE ARE NO TAXES DUE.

THIS SPACE FOR DATE RECEIVED STAMP

Please file two copies of this form together with the

Statements of Hawaii Income Tax Withheld and Wages Paid

(copy A of Form HW-2 or copy 1 of federal Form W-2).

— MAILING ADDRESS —

Hawaii Department of Taxation

P.O. Box 3827

Honolulu, HI 96812-3827

36

36

FORM HW-3

FORM HW-3

1

1