Reconciliation Of License Fee Withheld Form

ADVERTISEMENT

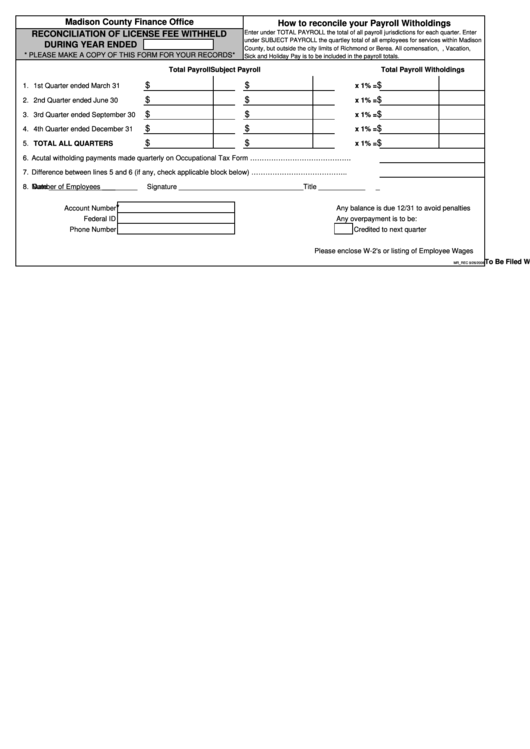

Madison County Finance Office

How to reconcile your Payroll Witholdings

Enter under TOTAL PAYROLL the total of all payroll jurisdictions for each quarter. Enter

RECONCILIATION OF LICENSE FEE WITHHELD

under SUBJECT PAYROLL the quartley total of all employees for services within Madison

DURING YEAR ENDED

County, but outside the city limits of Richmond or Berea. All comensation, i.e., Vacation,

* PLEASE MAKE A COPY OF THIS FORM FOR YOUR RECORDS*

Sick and Holiday Pay is to be included in the payroll totals.

Total Payroll

Subject Payroll

Total Payroll Witholdings

$

$

$

1.

1st Quarter ended March 31

x 1% =

$

$

$

2.

2nd Quarter ended June 30

x 1% =

$

$

$

3.

3rd Quarter ended September 30

x 1% =

$

$

$

4.

4th Quarter ended December 31

x 1% =

$

$

$

5.

TOTAL ALL QUARTERS

x 1% =

6.

Acutal witholding payments made quarterly on Occupational Tax Form …………………………………….

7.

Difference between lines 5 and 6 (if any, check applicable block below) …………………………………..

8.

Number of Employees _________

Signature ________________________________

Title ______________

Date _________________

*

Account Number

Any balance is due 12/31 to avoid penalties

Federal ID

Any overpayment is to be:

Phone Number

Credited to next quarter

Please enclose W-2's or listing of Employee Wages

To Be Filed With The 4th Quarter's Return By January 31

MR_REC 9/26/2006

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1