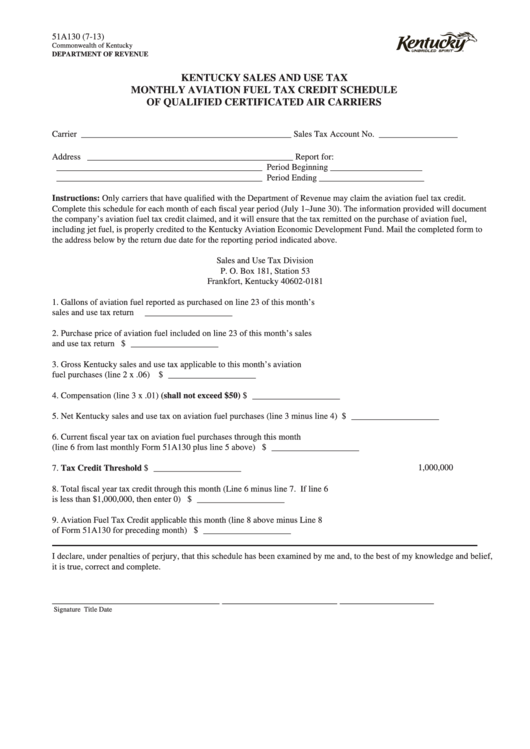

Form 51a130 - Kentucky Sales And Use Taxmonthly Aviation Fuel Tax Credit Scheduleof Qualified Certificated Air Carriers

ADVERTISEMENT

51A130 (7-13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KENTUCKY SALES AND USE TAX

MONTHLY AVIATION FUEL TAX CREDIT SCHEDULE

OF QUALIFIED CERTIFICATED AIR CARRIERS

Carrier ________________________________________________

Sales Tax Account No. __________________

Address _______________________________________________

Report for:

_______________________________________________

Period Beginning _____________________

_______________________________________________

Period Ending ________________________

Instructions: Only carriers that have qualified with the Department of Revenue may claim the aviation fuel tax credit.

Complete this schedule for each month of each fiscal year period (July 1–June 30). The information provided will document

the company’s aviation fuel tax credit claimed, and it will ensure that the tax remitted on the purchase of aviation fuel,

including jet fuel, is properly credited to the Kentucky Aviation Economic Development Fund. Mail the completed form to

the address below by the return due date for the reporting period indicated above.

Sales and Use Tax Division

P. O. Box 181, Station 53

Frankfort, Kentucky 40602-0181

1.

Gallons of aviation fuel reported as purchased on line 23 of this month’s

sales and use tax return ........................................................................................................

____________________

2.

Purchase price of aviation fuel included on line 23 of this month’s sales

and use tax return ................................................................................................................ $ ____________________

3.

Gross Kentucky sales and use tax applicable to this month’s aviation

fuel purchases (line 2 x .06) ............................................................................................... $ ____________________

4.

Compensation (line 3 x .01) (shall not exceed $50) .......................................................... $ ____________________

5.

Net Kentucky sales and use tax on aviation fuel purchases (line 3 minus line 4)............... $ ____________________

6.

Current fiscal year tax on aviation fuel purchases through this month

(line 6 from last monthly Form 51A130 plus line 5 above) ................................................ $ ____________________

1,000,000

7.

Tax Credit Threshold ....................................................................................................... $ ____________________

8.

Total fiscal year tax credit through this month (Line 6 minus line 7. If line 6

is less than $1,000,000, then enter 0) .................................................................................. $ ____________________

9.

Aviation Fuel Tax Credit applicable this month (line 8 above minus Line 8

of Form 51A130 for preceding month) ............................................................................... $ ____________________

I declare, under penalties of perjury, that this schedule has been examined by me and, to the best of my knowledge and belief,

it is true, correct and complete.

________________________________

______________________

__________________

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1