Salary Reduction Agreement Beneficiary Designation Form

ADVERTISEMENT

lan

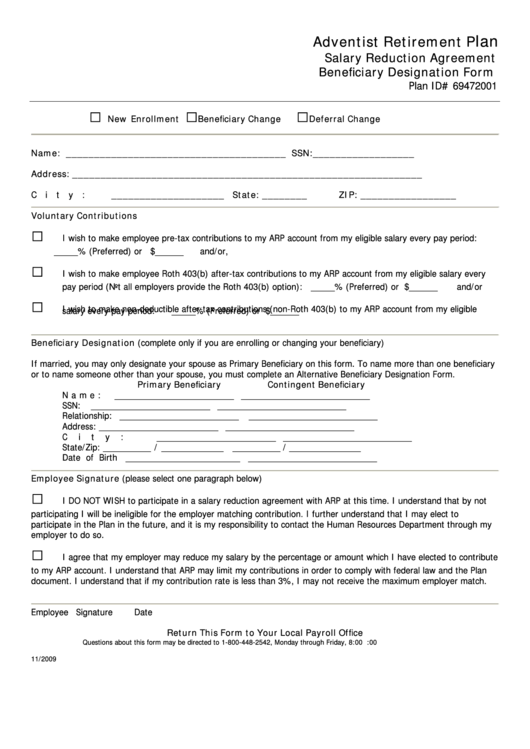

Adventist Retirement P

Salary Reduction Agreement

Beneficiary Designation Form

Plan ID# 69472001

New Enrollment

Beneficiary Change

Deferral Change

Name:

_______________________________________ SSN:__________________

Address:

______________________________________________________________

City:

____________________

State: ________

ZIP: _________________

Voluntary Contributions

I wish to make employee pre-tax contributions to my ARP account from my eligible salary every pay period:

_____% (Preferred) or $______

and/or,

I wish to make employee Roth 403(b) after-tax contributions to my ARP account from my eligible salary every

pay period (Not all employers provide the Roth 403(b) option): _____% (Preferred) or $______

and/or

I wish to make non-deductible after-tax contributions (non-Roth 403(b) to my ARP account from my eligible

salary every pay period:

_____% (Preferred) or $______

Beneficiary Designation (complete only if you are enrolling or changing your beneficiary)

If married, you may only designate your spouse as Primary Beneficiary on this form. To name more than one beneficiary

or to name someone other than your spouse, you must complete an Alternative Beneficiary Designation Form.

Primary Beneficiary

Contingent Beneficiary

Name:

_________________________

___________________________

SSN:

_________________________

___________________________

Relationship:

_________________________

___________________________

Address:

_________________________

___________________________

City:

_________________________

___________________________

State/Zip:

__________ / _____________

__________ / _______________

Date of Birth

________________________

___________________________

Employee Signature (please select one paragraph below)

I DO NOT WISH to participate in a salary reduction agreement with ARP at this time. I understand that by not

participating I will be ineligible for the employer matching contribution. I further understand that I may elect to

participate in the Plan in the future, and it is my responsibility to contact the Human Resources Department through my

employer to do so.

I agree that my employer may reduce my salary by the percentage or amount which I have elected to contribute

to my ARP account. I understand that ARP may limit my contributions in order to comply with federal law and the Plan

document. I understand that if my contribution rate is less than 3%, I may not receive the maximum employer match.

Employee Signature

Date

Return This Form to Your Local Payroll Office

Questions about this form may be directed to 1-800-448-2542, Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern

11/2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1