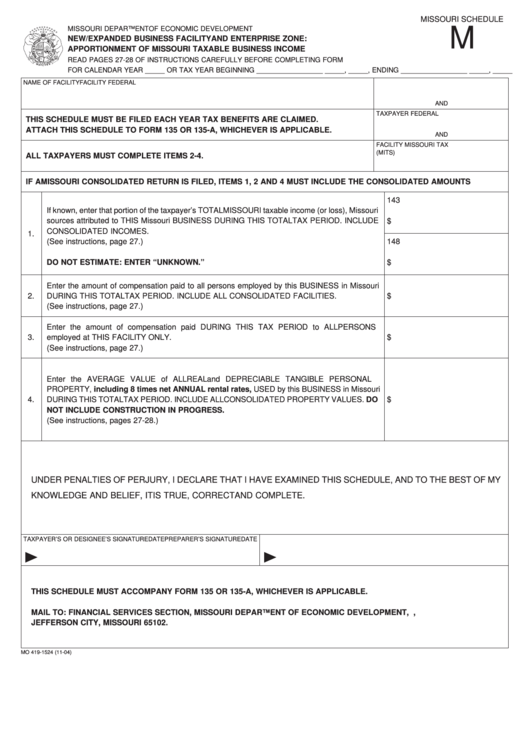

Form Mo 419-1524 - Missouri Schedule M - New/expanded Business Facility And Enterprise Zone: Apportionment Of Missouri Taxable Business Income

ADVERTISEMENT

MISSOURI SCHEDULE

M

MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT

NEW/EXPANDED BUSINESS FACILITY AND ENTERPRISE ZONE:

APPORTIONMENT OF MISSOURI TAXABLE BUSINESS INCOME

READ PAGES 27-28 OF INSTRUCTIONS CAREFULLY BEFORE COMPLETING FORM

S

FOR CALENDAR YEAR _____ OR TAX YEAR BEGINNING _________________ _____, _____, ENDING _________________ _____, _____

NAME OF FACILITY

FACILITY FEDERAL I.D. NO.

AND

TAXPAYER FEDERAL I.D. NO.

THIS SCHEDULE MUST BE FILED EACH YEAR TAX BENEFITS ARE CLAIMED.

ATTACH THIS SCHEDULE TO FORM 135 OR 135-A, WHICHEVER IS APPLICABLE.

AND

FACILITY MISSOURI TAX I.D. NO.

(MITS)

ALL TAXPAYERS MUST COMPLETE ITEMS 2-4.

IF A MISSOURI CONSOLIDATED RETURN IS FILED, ITEMS 1, 2 AND 4 MUST INCLUDE THE CONSOLIDATED AMOUNTS

143

If known, enter that portion of the taxpayer’s TOTAL MISSOURI taxable income (or loss), Missouri

sources attributed to THIS Missouri BUSINESS DURING THIS TOTAL TAX PERIOD. INCLUDE

$

CONSOLIDATED INCOMES.

1.

(See instructions, page 27.)

148

DO NOT ESTIMATE: ENTER “UNKNOWN.”

$

Enter the amount of compensation paid to all persons employed by this BUSINESS in Missouri

2.

DURING THIS TOTAL TAX PERIOD. INCLUDE ALL CONSOLIDATED FACILITIES.

$

(See instructions, page 27.)

Enter the amount of compensation paid DURING THIS TAX PERIOD to ALL PERSONS

3.

employed at THIS FACILITY ONLY.

$

(See instructions, page 27.)

Enter the AVERAGE VALUE of ALL REAL and DEPRECIABLE TANGIBLE PERSONAL

PROPERTY, including 8 times net ANNUAL rental rates, USED by this BUSINESS in Missouri

4.

DURING THIS TOTAL TAX PERIOD. INCLUDE ALL CONSOLIDATED PROPERTY VALUES. DO

$

NOT INCLUDE CONSTRUCTION IN PROGRESS.

(See instructions, pages 27-28.)

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS SCHEDULE, AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF, IT IS TRUE, CORRECT AND COMPLETE.

TAXPAYER’S OR DESIGNEE’S SIGNATURE

DATE

PREPARER’S SIGNATURE

DATE

❿

❿

THIS SCHEDULE MUST ACCOMPANY FORM 135 OR 135-A, WHICHEVER IS APPLICABLE.

MAIL TO: FINANCIAL SERVICES SECTION, MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT, P.O. BOX 118,

JEFFERSON CITY, MISSOURI 65102.

MO 419-1524 (11-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1