Affidavit Of Disabled Veteran Form

ADVERTISEMENT

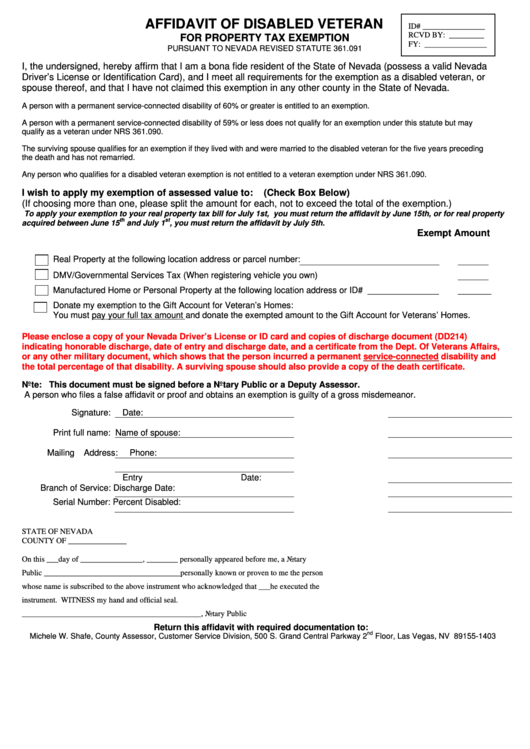

AFFIDAVIT OF DISABLED VETERAN

ID# ________________

RCVD BY: _________

FOR PROPERTY TAX EXEMPTION

FY: ________________

PURSUANT TO NEVADA REVISED STATUTE 361.091

I, the undersigned, hereby affirm that I am a bona fide resident of the State of Nevada (possess a valid Nevada

Driver’s License or Identification Card), and I meet all requirements for the exemption as a disabled veteran, or

spouse thereof, and that I have not claimed this exemption in any other county in the State of Nevada.

A person with a permanent service-connected disability of 60% or greater is entitled to an exemption.

A person with a permanent service-connected disability of 59% or less does not qualify for an exemption under this statute but may

qualify as a veteran under NRS 361.090.

The surviving spouse qualifies for an exemption if they lived with and were married to the disabled veteran for the five years preceding

the death and has not remarried.

Any person who qualifies for a disabled veteran exemption is not entitled to a veteran exemption under NRS 361.090.

I wish to apply my exemption of assessed value to:

(Check Box Below)

(If choosing more than one, please split the amount for each, not to exceed the total of the exemption.)

To apply your exemption to your real property tax bill for July 1st, you must return the affidavit by June 15th, or for real property

th

st

acquired between June 15

and July 1

, you must return the affidavit by July 5th.

Exempt Amount

Real Property at the following location address or parcel number:

DMV/Governmental Services Tax (When registering vehicle you own)

Manufactured Home or Personal Property at the following location address or ID# _______________

_______

Donate my exemption to the Gift Account for Veteran’s Homes:

You must pay your full tax amount and donate the exempted amount to the Gift Account for Veterans’ Homes.

Please enclose a copy of your Nevada Driver’s License or ID card and copies of discharge document (DD214)

indicating honorable discharge, date of entry and discharge date, and a certificate from the Dept. Of Veterans Affairs,

or any other military document, which shows that the person incurred a permanent service-connected disability and

the total percentage of that disability. A surviving spouse should also provide a copy of the death certificate.

Note: This document must be signed before a Notary Public or a Deputy Assessor.

A person who files a false affidavit or proof and obtains an exemption is guilty of a gross misdemeanor.

Signature:

Date:

Print full name:

Name of spouse:

Mailing Address:

Phone:

Entry Date:

Branch of Service:

Discharge Date:

Serial Number:

Percent Disabled:

STATE OF NEVADA

COUNTY OF _______________

On this ___day of ________________, ________ personally appeared before me, a Notary

Public ___________________________________personally known or proven to me the person

whose name is subscribed to the above instrument who acknowledged that ___he executed the

instrument. WITNESS my hand and official seal.

______________________________________________, Notary Public

Return this affidavit with required documentation to:

nd

Michele W. Shafe, County Assessor, Customer Service Division, 500 S. Grand Central Parkway 2

Floor, Las Vegas, NV 89155-1403

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1