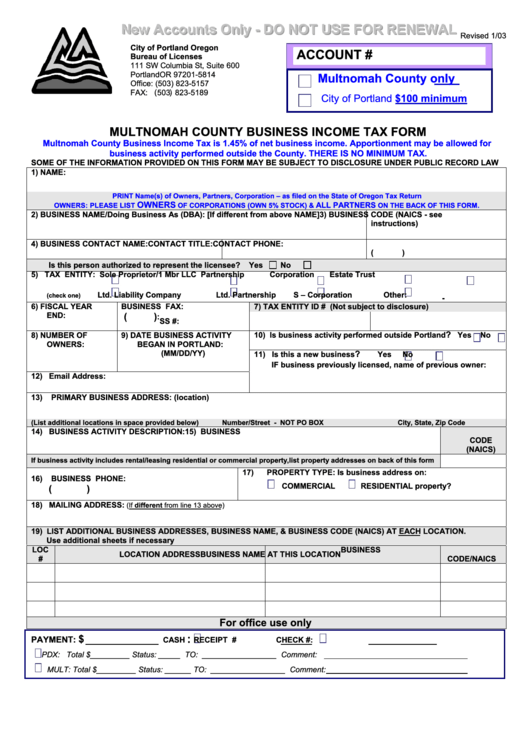

Multnomah County Business Income Tax Form - 2003

ADVERTISEMENT

N

e

w

A

c

c

o

u

n

t

s

O

n

l

y

-

D

O

N

O

T

U

S

E

F

O

R

R

E

N

E

W

A

L

N

e

w

A

c

c

o

u

n

t

s

O

n

l

y

-

D

O

N

O

T

U

S

E

F

O

R

R

E

N

E

W

A

L

N

e

w

A

c

c

o

u

n

t

s

O

n

l

y

-

D

O

N

O

T

U

S

E

F

O

R

R

E

N

E

W

A

L

Revised 1/03

City of Portland Oregon

ACCOUNT #

Bureau of Licenses

111 SW Columbia St, Suite 600

Portland OR 97201-5814

Multnomah County only

Office: (503) 823-5157

FAX: (503) 823-5189

City of Portland $100 minimum

MULTNOMAH COUNTY BUSINESS INCOME TAX FORM

Multnomah County Business Income Tax is 1.45% of net business income. Apportionment may be allowed for

business activity performed outside the County. THERE IS NO MINIMUM TAX.

SOME OF THE INFORMATION PROVIDED ON THIS FORM MAY BE SUBJECT TO DISCLOSURE UNDER PUBLIC RECORD LAW

1)

NAME:

PRINT Name(s) of Owners, Partners, Corporation – as filed on the State of Oregon Tax Return

OWNERS

ALL PARTNERS

OWNERS: PLEASE LIST

OF CORPORATIONS (OWN 5% STOCK) &

ON THE BACK OF THIS FORM.

2)

BUSINESS NAME/Doing Business As (DBA): [If different from above NAME]

3) BUSINESS CODE (NAICS - see

instructions)

4)

BUSINESS CONTACT NAME:

CONTACT TITLE:

CONTACT PHONE:

(

)

Is this person authorized to represent the licensee?

Yes

No

5)

TAX ENTITY:

Sole Proprietor/1 Mbr LLC

Partnership

Corporation

Estate

Trust

Ltd. Liability Company

Ltd. Partnership

S – Corporation

Other:

(check one)

6)

FISCAL YEAR

BUSINESS FAX:

7)

TAX ENTITY ID # (Not subject to disclosure)

END:

(

)

F.E.I.N:

SS #:

8)

NUMBER OF

9)

DATE BUSINESS ACTIVITY

?

10) Is business activity performed outside Portland

Yes

No

OWNERS:

BEGAN IN PORTLAND:

(MM/DD/YY)

?

11) Is this a new business

Yes

No

IF business previously licensed, name of previous owner:

12) Email Address:

13)

PRIMARY BUSINESS ADDRESS: (location)

(List additional locations in space provided below)

Number/Street - NOT PO BOX

City, State, Zip Code

14) BUSINESS ACTIVITY DESCRIPTION:

15) BUSINESS

CODE

(NAICS)

If business activity includes rental/leasing residential or commercial property, list property addresses on back of this form

17)

PROPERTY TYPE: Is business address on:

16)

BUSINESS PHONE:

COMMERCIAL

RESIDENTIAL property?

(

)

18) MAILING ADDRESS:

(If different from line 13 above)

19) LIST ADDITIONAL BUSINESS ADDRESSES, BUSINESS NAME, & BUSINESS CODE (NAICS) AT EACH LOCATION.

Use additional sheets if necessary

LOC

BUSINESS

LOCATION ADDRESS

BUSINESS NAME AT THIS LOCATION

#

CODE/NAICS

For office use only

:

$

PAYMENT:

CASH

RECEIPT #

CHECK #:

PDX: Total $_________ Status: _____ TO: _________________ Comment:

MULT: Total $_________ Status: ______ TO: _________________ Comment:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2