Financial Services Development Credit Worksheet - For Pass-Through To Shareholders

ADVERTISEMENT

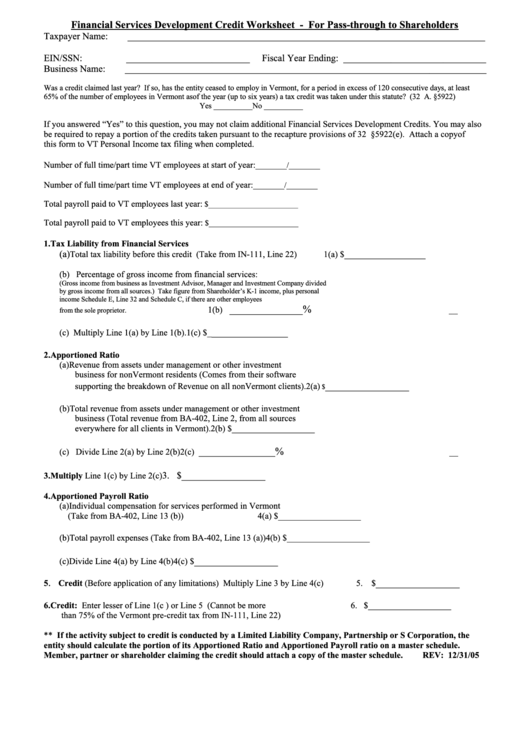

Financial Services Development Credit Worksheet - For Pass-through to Shareholders

Taxpayer Name:

___________________________________________________________________________

EIN/SSN:

__________________________

Fiscal Year Ending: ______________________________

Business Name:

____________________________________________________________________________

Was a credit claimed last year? If so, has the entity ceased to employ in Vermont, for a period in excess of 120 consecutive days, at least

65% of the number of employees in Vermont as of the year (up to six years) a tax credit was taken under this statute? (32 V.S.A. §5922)

Yes __________

No __________

If you answered “Yes” to this question, you may not claim additional Financial Services Development Credits. You may also

be required to repay a portion of the credits taken pursuant to the recapture provisions of 32 V.S.A. §5922(e). Attach a copy of

this form to VT Personal Income tax filing when completed.

Number of full time/part time VT employees at start of year:

________/________

Number of full time/part time VT employees at end of year:

________/________

Total payroll paid to VT employees last year:

$_______________________

Total payroll paid to VT employees this year:

$_______________________

1. Tax Liability from Financial Services

(a)

_________________

Total tax liability before this credit (Take from IN-111, Line 22)

1(a) $

(b) Percentage of gross income from financial services:

(Gross income from business as Investment Advisor, Manager and Investment Company divided

by gross income from all sources.) Take figure from Shareholder’s K-1 income, plus personal

income Schedule E, Line 32 and Schedule C, if there are other employees

______________%

1(b)

from the sole proprietor.

________________

(c) Multiply Line 1(a) by Line 1(b).

1(c) $_

2. Apportioned Ratio

(a) Revenue from assets under management or other investment

business for nonVermont residents (Comes from their software

________________

supporting the breakdown of Revenue on all nonVermont clients).

2(a)

$

(b) Total revenue from assets under management or other investment

business (Total revenue from BA-402, Line 2, from all sources

everywhere for all clients in Vermont).

2(b) $___________________

%

________________

(c) Divide Line 2(a) by Line 2(b)

2(c)

________________

3. $

3. Multiply Line 1(c) by Line 2(c)

4. Apportioned Payroll Ratio

(a) Individual compensation for services performed in Vermont

(Take from BA-402, Line 13 (b))

4(a) $___________________

(b) Total payroll expenses (Take from BA-402, Line 13 (a))

4(b) $___________________

________________

(c) Divide Line 4(a) by Line 4(b)

4(c) $

.

________________

5

Credit (Before application of any limitations) Multiply Line 3 by Line 4(c)

5. $

6. Credit: Enter lesser of Line 1(c ) or Line 5 (Cannot be more

6. $___________________

than 75% of the Vermont pre-credit tax from IN-111, Line 22)

** If the activity subject to credit is conducted by a Limited Liability Company, Partnership or S Corporation, the

entity should calculate the portion of its Apportioned Ratio and Apportioned Payroll ratio on a master schedule.

Member, partner or shareholder claiming the credit should attach a copy of the master schedule.

REV: 12/31/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1