SAVE AS

Clear All Fields

Print Document

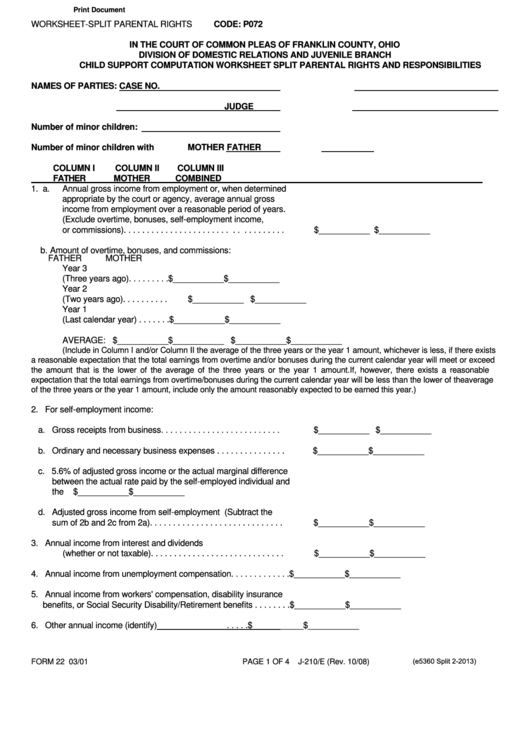

WORKSHEET-SPLIT PARENTAL RIGHTS

CODE: P072

IN THE COURT OF COMMON PLEAS OF FRANKLIN COUNTY, OHIO

DIVISION OF DOMESTIC RELATIONS AND JUVENILE BRANCH

CHILD SUPPORT COMPUTATION WORKSHEET SPLIT PARENTAL RIGHTS AND RESPONSIBILITIES

NAMES OF PARTIES:

CASE NO.

JUDGE

Number of minor children:

Number of minor children with

MOTHER

FATHER

COLUMN I

COLUMN II

COLUMN III

FATHER

MOTHER

COMBINED

1. a.

Annual gross income from employment or, when determined

appropriate by the court or agency, average annual gross

income from employment over a reasonable period of years.

(Exclude overtime, bonuses, self-employment income,

or commissions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$___________ $___________

b.

Amount of overtime, bonuses, and commissions:

FATHER

MOTHER

Year 3

(Three years ago). . . . . . . . .

$___________ $___________

Year 2

(Two years ago). . . . . . . . . .

$___________ $___________

Year 1

(Last calendar year) . . . . . . .

$___________ $___________

AVERAGE:

$___________ $___________ $___________ $___________

(Include in Column I and/or Column II the average of the three years or the year 1 amount, whichever is less, if there exists

a reasonable expectation that the total earnings from overtime and/or bonuses during the current calendar year will meet or exceed

the amount that is the lower of the average of the three years or the year 1 amount. If, however, there exists a reasonable

expectation that the total earnings from overtime/bonuses during the current calendar year will be less than the lower of the average

of the three years or the year 1 amount, include only the amount reasonably expected to be earned this year.)

2. For self-employment income:

a. Gross receipts from business. . . . . . . . . . . . . . . . . . . . . . . . . .

$___________ $___________

b. Ordinary and necessary business expenses . . . . . . . . . . . . . . .

$___________ $___________

c. 5.6% of adjusted gross income or the actual marginal difference

between the actual rate paid by the self-employed individual and

the F.I.C.A. rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$___________ $___________

d. Adjusted gross income from self-employment (Subtract the

sum of 2b and 2c from 2a). . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$___________ $___________

3. Annual income from interest and dividends

(whether or not taxable). . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$___________ $___________

4. Annual income from unemployment compensation. . . . . . . . . . . . .

$___________ $___________

5. Annual income from workers' compensation, disability insurance

benefits, or Social Security Disability/Retirement benefits . . . . . . . .

$___________ $___________

6. Other annual income (identify)

. . . . .

$___________ $___________

(e5360 Split 2-2013)

FORM 22 03/01

PAGE 1 OF 4

J-210/E (Rev. 10/08)

1

1 2

2 3

3 4

4