Cd-0773-0313 Spouse Rollover Election Form For Distribution From The Pension Fund

ADVERTISEMENT

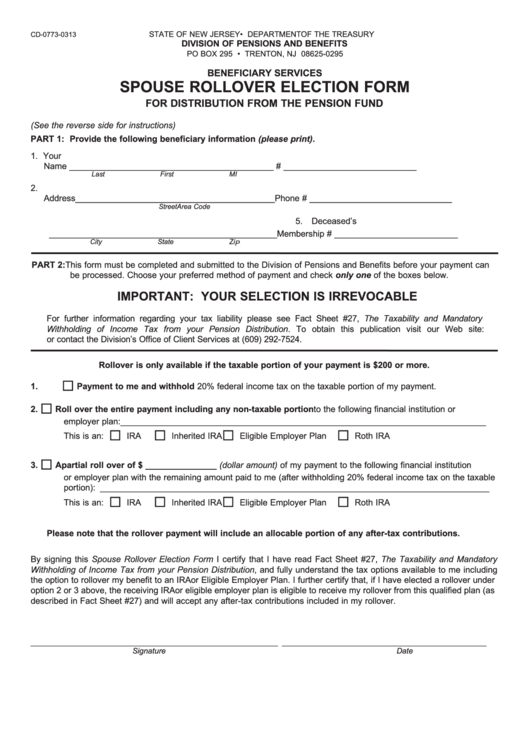

STATE OF NEW JERSEY • DEPARTMENT OF THE TREASURY

CD-0773-0313

DIVISION OF PENSIONS AND BENEFITS

PO BOX 295 • TRENTON, NJ 08625-0295

BENEFICIARY SERVICES

SPOUSE ROLLOVER ELECTION FORM

FOR DISTRIBUTION FROM THE PENSION FUND

(See the reverse side for instructions)

PART 1: Provide the following beneficiary information (please print).

1. Your

Name ___________________________________________

3. Soc. Sec. # ____________________________

Last

First

MI

2. Mailing

4. Daytime

Address __________________________________________

Phone # ______________________________

Street

Area Code

5. Deceased’s

________________________________________________

Membership # __________________________

City

State

Zi P

PART 2: This form must be completed and submitted to the Division of Pensions and Benefits before your payment can

be processed. Choose your preferred method of payment and check only one of the boxes below.

IMPORTANT: YOUR SELECTION IS IRREVOCABLE

For further information regarding your tax liability please see Fact Sheet #27, The Taxability and Mandatory

Withholding of Income Tax from your Pension Distribution. To obtain this publication visit our Web site:

or contact the Division’s Office of Client Services at (609) 292-7524.

Rollover is only available if the taxable portion of your payment is $200 or more.

1.

Payment to me and withhold 20% federal income tax on the taxable portion of my payment.

2.

Roll over the entire payment including any non-taxable portion to the following financial institution or

employer plan: _____________________________________________________________________________

This is an:

IRA

Inherited IRA

Eligible Employer Plan

Roth IRA

3.

A partial roll over of $ _______________ (dollar amount) of my payment to the following financial institution

or employer plan with the remaining amount paid to me (after withholding 20% federal income tax on the taxable

portion): __________________________________________________________________________________

This is an:

IRA

Inherited IRA

Eligible Employer Plan

Roth IRA

Please note that the rollover payment will include an allocable portion of any after-tax contributions.

By signing this Spouse Rollover Election Form I certify that I have read Fact Sheet #27, The Taxability and Mandatory

Withholding of Income Tax from your Pension Distribution, and fully understand the tax options available to me including

the option to rollover my benefit to an IRA or Eligible Employer Plan. I further certify that, if I have elected a rollover under

option 2 or 3 above, the receiving IRA or eligible employer plan is eligible to receive my rollover from this qualified plan (as

described in Fact Sheet #27) and will accept any after-tax contributions included in my rollover.

__________________________________________________________ ________________________________________________

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2